January OPEC Data Shows Output Down

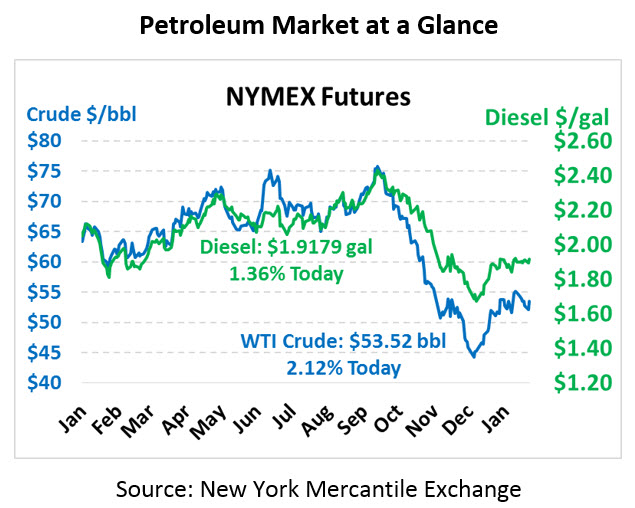

Markets are rebounding from last week’s dip in prices, with markets becoming more hopeful that a second government shutdown will be averted. Crude oil is trading higher this morning at $53.52, up $1.11.

Fuel prices are also getting a lift this morning. Diesel prices are trading at $1.9179, a gain of 2.6 cents since yesterday’s close. Gasoline prices are trading at $1.4371, up 1.8 cents.

OPEC released its Monthly Oil Market Report for January, showing that OPEC production fell 0.8 MMbpd from December levels, coming in quite close to the agreed upon production quotas. Saudi Arabia led the way lower, cutting 350 kbpd. Saudi Arabia plans to cut production even further in March, putting overall OPEC output well below agreed on levels. Still, OPEC’s report this week heralded higher supply and lower demand for the remainder of 2019, painting a bit more bearish picture later this year.

Markets are also getting a boost from rising optimism for a positive resolution to US-China trade talks. Although both parties are a long way from a comprehensive deal, markets are betting on at least an avoidance of further tariffs. March 1 is the deadline, after which the US will hike tariffs from 10% to 25% on $200 billion in goods. Talks are underway in Beijing to avert this increase, which would further hinder trade between the world’s two largest economies.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.