Is the Oil Love Affair Over?

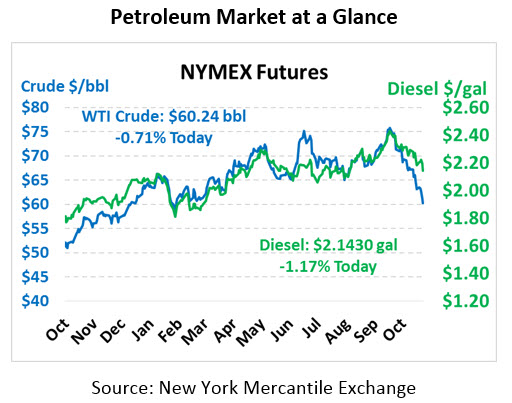

Since February 14 – Valentine’s Day – WTI crude prices have traded above $60/bbl, a 9-month love affair between traders and products. With prices now flirting with sub-$60 levels, traders are wondering whether the romance is over for oil. This morning, crude prices are trading at $60.24, down 43 cents since yesterday’s close.

Fuel prices have also taken a beating, much to the delight of consumers. With a few weeks before Thanksgiving travels take over, gasoline prices are at their lowest point since October 2017, trading at $1.6206 after a 2.4 cent loss this morning. Diesel prices are still much stronger despite shedding almost 7 cents yesterday – one need only look to last August to find similar prices, showing the product’s resilience. Today diesel prices are trading at $2.1430, down 2.5 cents from yesterday’s close.

Markets took another nosedive yesterday after a report that Saudi Arabia is funding a think tank study on the effects of disbanding OPEC – a wild scenario given 60 years of OPEC-dominated markets. Although on its face the study sounds like the government is toying with breaking up OPEC, it seems more likely the report will be a defense of the group’s actions to provide political cover. Studies like these take time, so it’ll be a while before we hear the final results.

In the meantime, the actual chatter from OPEC is painting a more bullish picture. The group is meeting on Sunday to discuss market trends and the viability of tightening production quotas once more in 2019. Various OPEC members have noted their preference for Brent crude prices above $70, so the current weak market may fuel a consensus on tighter production next year.

So is the oil love affair over? It’s too soon to tell – OPEC will almost certainly keep trying to court prices higher, but the market may not prove responsive if demand continues to show weakness in developing countries.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.