Is OPEC+ Cutting Enough to Move Markets

Yesterday, WTI crude started the day up about a dollar after the news of the historic cuts by OPEC+. Skepticism of the deal began to sway the market and the weight of crude demand destruction finally overshadowed the supply cuts as the market closed the day slightly lower. Prices continue lower this morning even as Saudi Arabia stated that they would be willing to make deeper cuts if needed at the June OPEC+ meeting.

Some of the skepticism from the deal comes from the fact that OPEC+ is expecting cuts from other major suppliers that do not traditionally cut supplies along with cartel policies. Countries such as Brazil have stated that they would not require producers to cut production. In the US, the Department of Energy stated that all cuts would stem from economics and not from policy. (Bloomberg)

Interesting trends from the forward curve show that while near-term oil prices did fall after OPEC’s announcement, future prices in late 2020 and beyond actually moved higher – resulting in an overall steepening of the forward curve. The market is supportive of OPEC’s deal, they just don’t believe it will do enough to correct the immediate supply glut we have. By June, the market believes the cuts will cause oil prices to begin moving higher as inventories begin the slow return to normal.

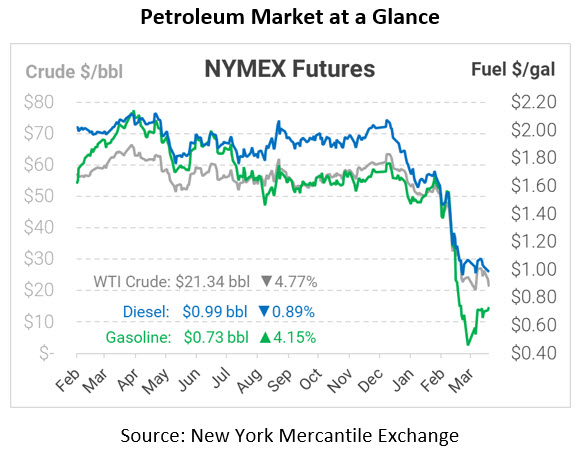

In early trading today, crude prices are continuing their downward trend. Crude is currently trading at $21.34, a loss of $1.07.

Fuel prices are mixed this morning. Diesel is trading at $0.9857, a loss of 0.9 cents. Gasoline is trading at $0.7325, a gain of 2.9 cents.

This article is part of Crude

Tagged: Brazil, DOE, forward curve, forward curveOPEC, opec, Supply Cuts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.