Iran Fires Missiles at Mock US Carrier

After moderate losses during yesterday’s trading session, oil prices are recovering slightly, supported by surprising oil inventory data from the API. While economic stimulus remains the critical story of the day, markets are also eyeing geopolitical unrest in some areas of the world.

In the Middle East, Iran appears to have built a replica aircraft carrier with the express intentions of launching missiles at it for a military exercise. The missile strikes took place in the Strait of Hormuz, one of the world’s most important hotspots for maritime oil deliveries. Although the exercise has had no direct impact on shipments through the critical strait, it serves as a salient reminder that tensions between the US and Iran remain high, particularly following America’s drone strikes on Iranian General Soleimani in January.

The API released its weekly inventory report, which showed a steep crude draw compared to an expected build. Declining crude stocks are supporting the market despite surprise builds for both diesel and gasoline. Markets will watch for the EIA’s data later today.

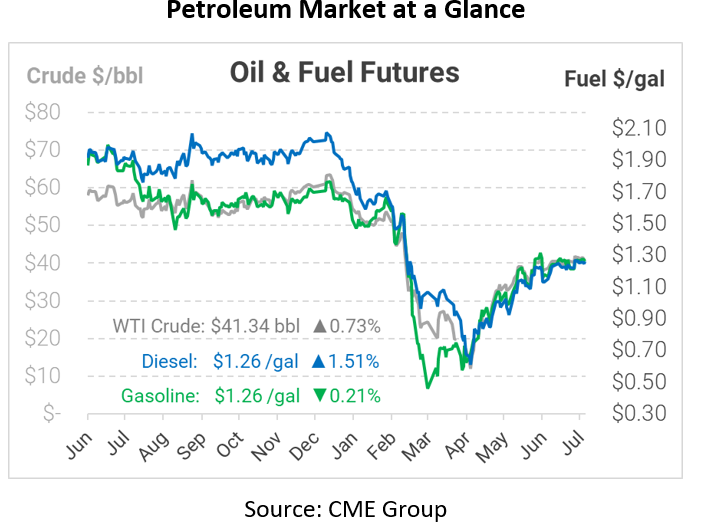

Crude oil prices this morning are posting moderate gains. WTI crude is trading at $41.34, up 30 cents from Tuesday’s closing price.

Fuel prices are mixed. Diesel prices are feeling support from the moderate build, which signals a slowdown in inventories builds. Diesel is trading at $1.2608, up 1.9 cents. Gasoline, which saw a surprisingly large build, is trading at $1.2629, down 0.3 cents.

This article is part of Daily Market News & Insights

Tagged: API, Inventories, Iran, Middle East, missile

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.