Iran Deal Possible Within Days – Lower Prices Ahead?

While all eyes have been focused on the Russia-Ukraine border, negotiators have been making quiet progress on the US-Iran nuclear deal. Now, US negotiators are saying that the coming days will be make-or-break for the deal, and Iran’s top negotiator hinted that an agreement is “closer than ever.” With Citi analysts targeting a drop to $65/bbl oil this year assuming the US and Iran agree, the US-Iran nuclear deal could provide the relief consumers so desperately need.

Although the deal has made significant strides, it’s not a guarantee. Iran is reportedly just weeks away from having enough weaponized uranium to build a bomb, though several long and complex steps stand between having the materials and creating the actual weapon. Iran advancing their nuclear program further would almost certainly derail any agreement, sending prices rocketing higher.

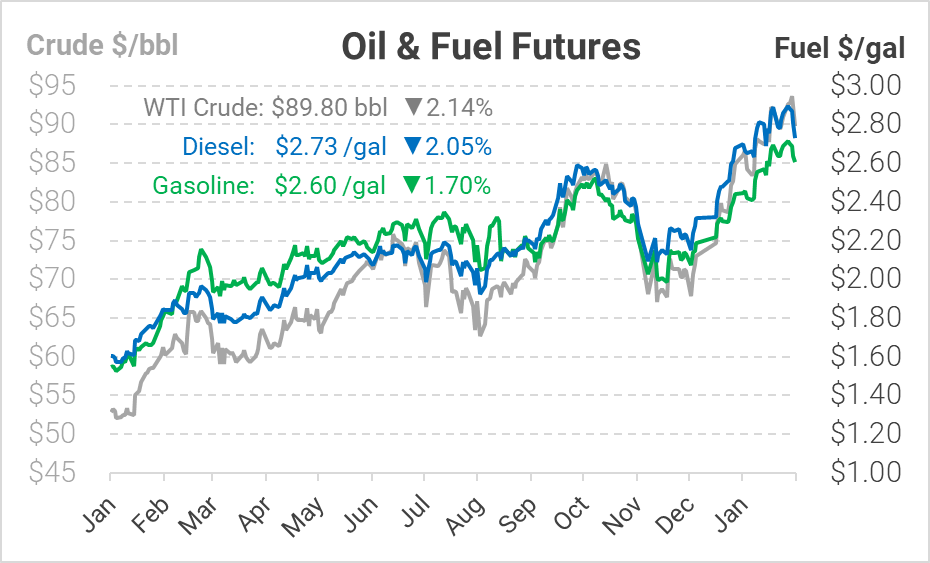

The US has proposed lifting sanctions if Iran gives up its pursuit of nuclear weapons and resumes international inspections at its uranium processing facilities. Sanctions, imposed in 2018 when President Trump unilaterally withdrew from the nuclear agreement, took nearly 2 million barrels per day of oil out of international markets. Bank of America reports suggest that oil markets could flip from tight to oversupplied with the return of Iran’s supply, meaning a quick drop in fuel prices. This week, prices dipped below $90/bbl as the deal overshadowed tensions with Russia. Prices could fall $5-$10 immediately after the deal is signed, with further declines throughout the year.

But a deal would not immediately guarantee sanctions are lifted. The US is only indirectly involved in negotiations, which are happening in Vienna between Iran, Britain, China, France, Germany, and Russia. Analysts suggest that if an accord is reached, sanctions would be lifted within 1-3 months – assuming Congress agrees to reenter the nuclear deal. There are still many hurdles to overcome. Still, consumers are hoping for the win-win of added nuclear security and substantially lower fuel prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.