Inventories Drop to Lowest Levels Since January 2020

This morning oil prices rose as yesterday’s report of crude oil stockpiles falling spread through the market. According to reports, the U.S. stockpiles fell to their lowest since January of 2020. While it seemed that oil prices were stalling in their rally, the across-the-board draw gave markets another boost. Crude opened the day at $72.40, diesel at $2.1535, and gasoline at $2.3122.

Last month crude reached the $75 mark for the first time in two years, but the rally slowed once OPEC+ agreed to lift production levels. So far, rising COVID-19 variant cases do not seem to be having that much of an impact on fuel, especially here in the United States. The Federal Reserve said yesterday that they are very confident that the US’s economic recovery is on track regardless of an increase in COVID-19 variant cases. Along with this ongoing economic recovery factor, Iran claims that because the United States has continually halted talks between the two countries, there has been a constant delay in Iranian oil returning.

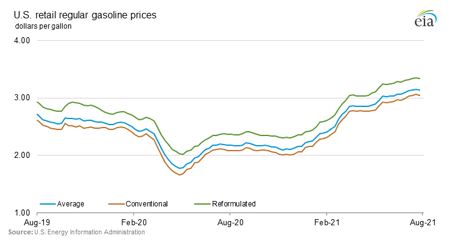

Prices at the pump continue to increase around the country. Analysts are suggesting due to the OPEC+ deal that was finally reached, consumers should expect to see a return to normal at the pump, but not immediately. It will take some time for prices to balance out, and we should be prepared not to see drastic changes until the end of the year. The chart below reflects EIA data published over two years.

The chart is interesting because it shows the continuation of a steady rise in prices regardless of what kind of agreement OPEC+ came to. This ties back to the idea that prices will not begin to stabilize for people just yet but may start to show signs of healing toward the end of the year.

This article is part of Daily Market News & Insights

Tagged: crude, eia, Futures, stockpiles

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.