Inflation: What Is It Good For?

The US Dollar is up and fuel prices are down this morning as markets continue monitoring inflation trends. The USD climbed to a 52-week high, which makes fuel proportionately more expensive for foreign countries and therefore drives down trading (and, depending on how much value swings, can also cause physical demand destruction). The Fed announced a while back that they would begin easing bond purchases, a sign that they’re trying to curb inflationary forces. So why is inflation such a problem?

Ray Dalio, who is both a legendary investor and studied economic historian, posted a note on LinkedIn in response to inflation fears. He said that inflation is “no surprise” due to historic government spending and robust consumer spending. He notes that inflation may make us all feel richer – since we’re earning more and have more dollars to spend – yet it reduces our buying power. Earning 10% more than last year isn’t helpful if your expenditures rise 20%. He notes that so far, the US is on the wrong path, suggesting that further inflation is coming.

Inflation can be good, bad, or neutral depending on who you ask. It’s great for debtors (like the US government, or people with home mortgages) because it shrinks the value of your debt. Homeowners are seeing this today, with housing prices exploding but fixed-rate mortgages remaining steady month-to-month. For savers, inflation erodes the value of your money – so someone who’s saved $1 million for retirement may not be as comfortable as they had planned. For many others it’s neutral, or a blend of good and bad. Some businesses face higher costs, but can pass those higher costs on consumers, leaving them net neutral.

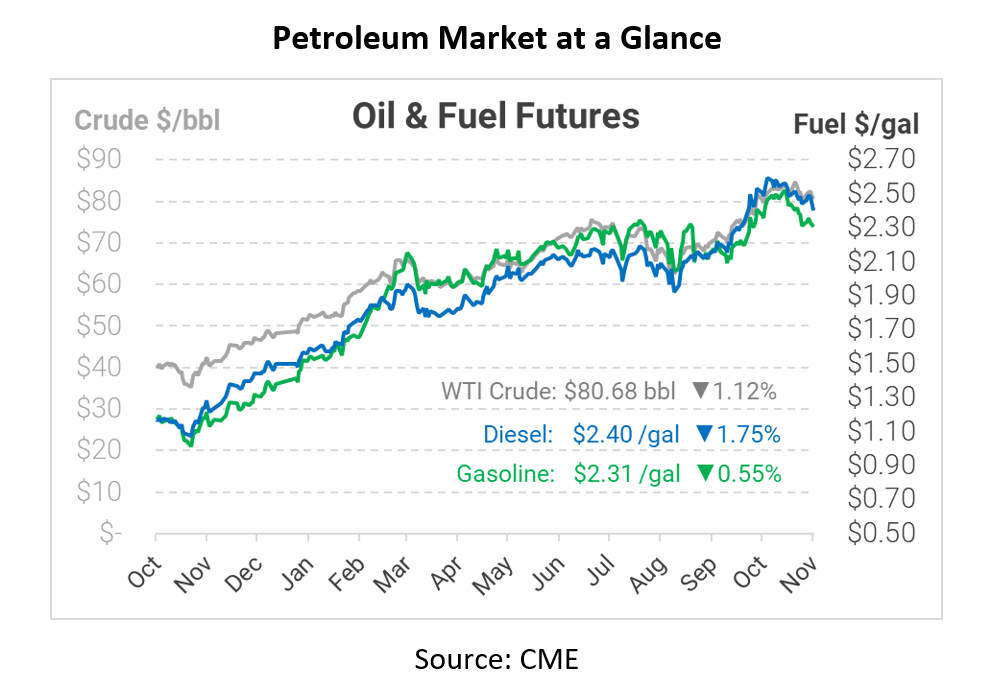

For fuel markets, inflation is a tricky subject. Because fuel costs are one of the factors used to calculate inflation, the relationship can move in both directions. High fuel prices contribute directly to high inflation, but rising inflation can also cause oil traders to act differently. Inflation typically signals that the economy is strong – which is bullish. But it also leads central banks to increase interest rates and stop stimulating financial markets, leading traders away from risky stocks and commodities and towards high-return bonds.

Ultimately, the effect between inflation and oil prices is best summarized in the statement: “The best cure for high prices is high prices.” Rising oil prices will both incentivize more producers to provide supplies in the future and cause consumers to curb their spending. This has been the case throughout oil market history. The 2008 explosion in fuel prices came before the 2009 depression. High prices in 2011-2014 lead US shale producers to increase production, leading to OPEC flooding markets to gain market share. It’s an endless cycle of prices rising, falling, and rising again. Oil prices will continue rising until the market can no longer support such high prices, which will eventually bring a return to lower prices. The trouble is, no one knows when that eventual crash will come – next month, next year, or next decade.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.