IMF Forecasts Largest Contraction Since Great Depression

On Tuesday, the IMF reported that global gross domestic product is forecast to shrink 3% this year. This newest forecast, the first since the coronavirus’ effect began to take center stage, compares to the January forecast of a 3.3% expansion. This contraction would mark the largest decline since the Great Depression and is far greater than the contraction felt in 2009 during the financial crisis which measured a mere 0.1%.

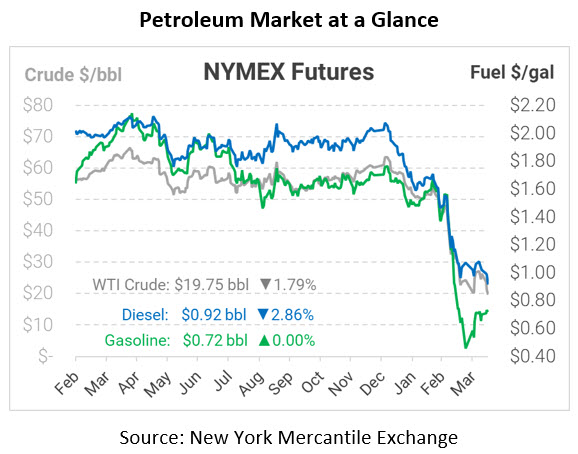

WTI crude is trading lower this morning on news from the IEA reporting continuing oversupply to markets and consistent demand declines due to coronavirus quarantines. The OPEC+ deal news has mostly been absorbed by the market with little fanfare. Investors had been expecting larger cuts to outweigh the demand destruction caused by the coronavirus. The cuts as they are will not alleviate the supply surplus in the short term which will lead to a growing global oil surplus and continued declining crude prices. Oil production in the US has already begun to see production declines due to low prices and not due to policy.

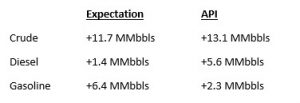

The API’s data last night:

The API reported a larger-than-expected build for crude of 13.1 MMbbls versus an expected build of 11.7 MMbbls. At Cushing, stocks rose with a build of 5.2 MMbbls. The API reported that gasoline had a smaller-than-expected build and distillates had a larger-than-expected build. The hefty diesel build is putting downward pressure on a product which thus far has avoided the severe price collapse seen in gasoline markets. The EIA will report numbers later this morning.

Crude prices are down this morning. WTI Crude is trading at $19.75, a loss of 36 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $0.9172, a loss of 2.7 cents. Gasoline is unchanged at $0.7200.

This article is part of COVID-19

Tagged: API report, global oil surplus, Oil production, opec, US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.