IMF Cuts Global Growth Forecast Again

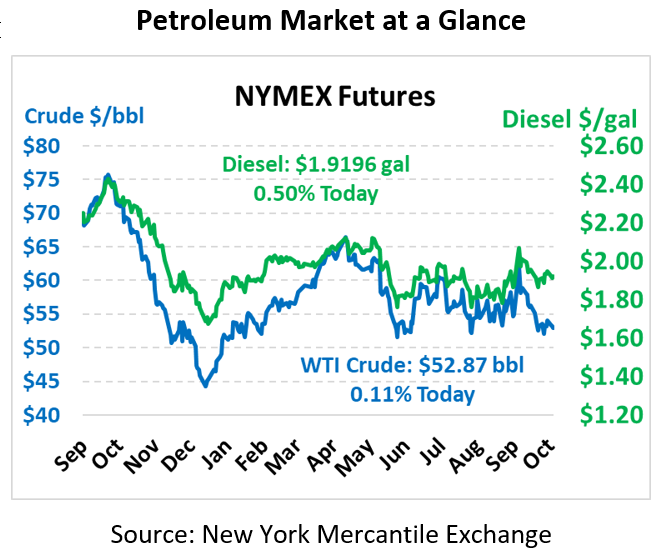

Prices are flat this morning as the specter of slower economic growth is weighed against potential OPEC cuts. WTI Crude is trading at $52.87, a gain of 6 cents.

Fuel is mixed this morning. Diesel is trading at $1.9196, a gain of 1 cent. Gasoline is trading at $1.6081, a loss of 0.6 cents.

On Tuesday, the IMF published its fifth straight cut to its 2019 global growth forecast in its World Economic Outlook. Growth this year is now forecast to be 3.0%, down from previous the July forecast of 3.2%; last year, 2019 growth was expected to be 3.9%. The cut places global growth at its slowest pace since the 2008-2009 financial crisis. Growth is expected to pick up next year with 3.4% growth in 2020. Both now and in the future, trade concerns are the dominant concern for the IMF, with the US-China trade war featuring prominently in their analysis. Crude was down on the news yesterday but is relatively flat in early trading this morning.

In OPEC news, OPEC Secretary-General Mohammad Barkindo stated that OPEC+ may plan for greater cuts in crude production at their December meeting. In addition, the EIA believes that OPEC will face challenges next year, as fuel-demand growth could slow due to a weakening economy and as rival supply growth increases.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.