IMF Cuts Global and US Forecasts

On Wednesday, WTI Crude fell more than $2 as it followed US equities lower on fears of a resurgence of coronavirus cases. Swelling crude inventories reported by the EIA and a surge of new COVID-19 cases around the nation have raised concerns about crude demand in the US and abroad, dragging prices lower.

The IMF said Wednesday in its World Economic Outlook update that the COVID-19 pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast. The IMF now estimates a contraction of 4.9% in global gross domestic product in 2020, which is lower than the 3% fall it predicted in April. Looking at country forecasts, the United States is expected to contract by 8% this year. The IMF had previously estimated a contraction of 5.9%.

The EIA reported an increase for crude of 1.4 MMbbls, versus an expected increase of 0.3 MMbbls. At Cushing, the EIA reported that stocks fell by 1.0 MMbbls. US crude oil inventories are about 16% above the five-year average for this time of year. Distillates reported a surprise build and continue to trend roughly 28% above the five-year average. Gasoline reported a draw in stocks and is about 9% above the five-year average.

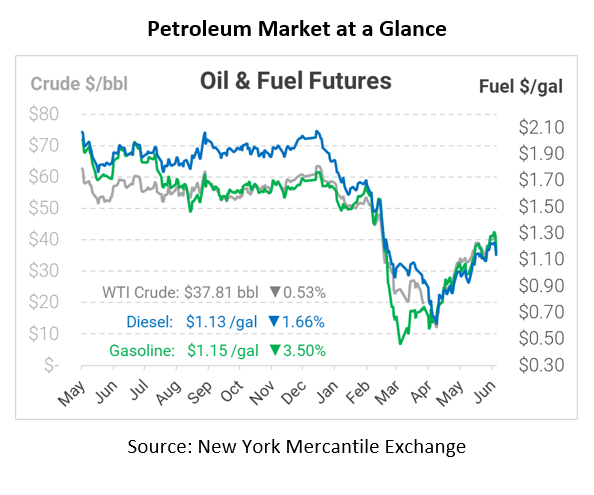

Crude prices are down this morning. WTI Crude is trading at $37.81, a loss of 20 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.1317, a loss of 1.9 cents. Gasoline is trading at $1.1545, a loss of 4.2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.