IEA World Energy Outlook – Crystal Ball?

Crude fell nearly 3% on Monday, as supply came back online from multiple sources. The return of supply was the major factor moving markets lower yesterday and continues to pressure markets today. Crude is recouping some of its losses this morning on positive news coming out of China. China is the world’s largest crude importer and reported that in September, they imported 11.8 MMbpd. This number was up 5.5% from last month and up 17.5% from last year.

The IEA came out with its annual World Energy Outlook today. In the report, they say that forecasting has become harder than ever because, “The Covid-19 pandemic has caused more disruption to the energy sector than any other event in recent history, leaving impacts that will be felt for years to come.” There is no clear path forward; instead, there are many different possible scenarios. that makes any forecasting hard. The IEA expects global energy demand to drop 5% in 2020. The report also sees global energy investment dropping by 18% this year. Oil demand in advanced economies is forecast to decline 4 MMbpd between now and 2030.

Their analysis continues saying, “Uncertainty over the duration of the pandemic, its economic and social impacts, and the policy responses open up a wide range of possible energy futures.” There are many variables and a wide range of possibilities. To sum it up, a lot of different scenarios could play out depending on how long the pandemic lasts, how and when economies recover, and how society has changed due to the new world we live in and the new challenges we face.

In the US, supply began to come back online after Hurricane Delta moved through the Gulf. On Sunday, workers began to return to Gulf platforms that had been evacuated ahead of the storm. In Libya, force majeure was lifted from its largest oil field, Sharara. In Norway, the successful end of a workers strike through mediation will return supply back to the market. The strike had threatened to cut 25% of Norway’s oil and gas output. To read more about these topics click here.

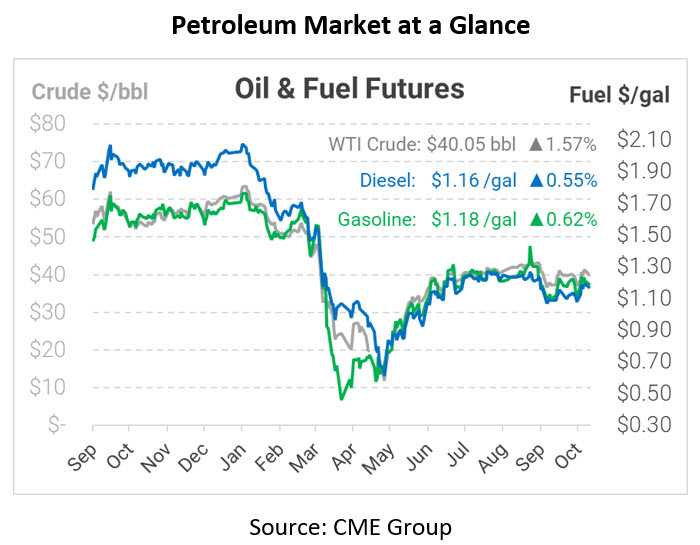

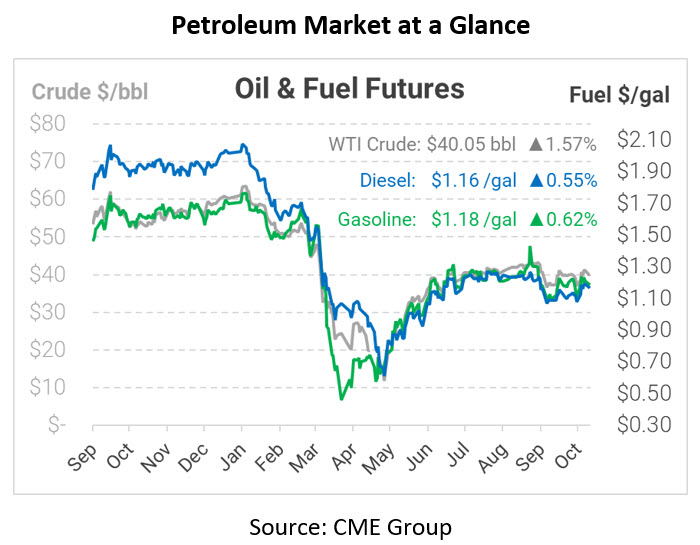

In early trading today, crude prices are up. Crude is currently trading at $40.05, a gain of 62 cents.

Fuel prices are up this morning. Diesel is trading at $1.1635, a gain of 0.6 cents. Gasoline is trading at $1.1830, a gain of 0.7 cents.

This article is part of Daily Market News & Insights

Tagged: hurricane, IEA, Libya, Norway, World Energy Outlook

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.