IEA Warns Renewable Growth Must Increase

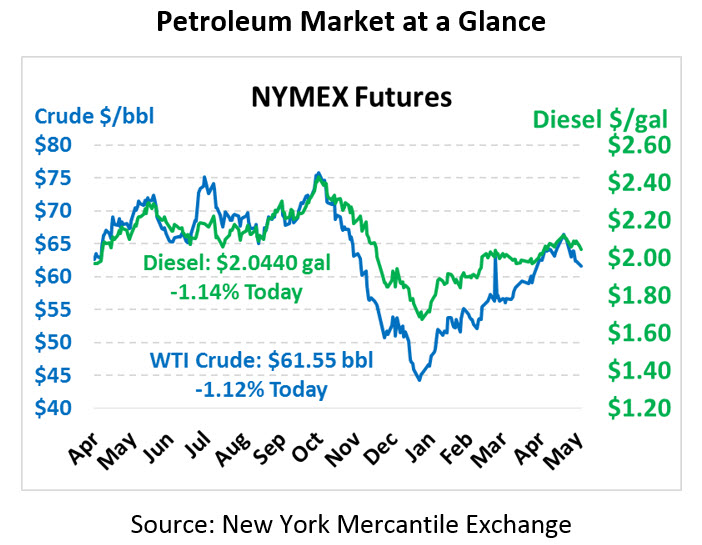

After opening quite low yesterday, oil prices managed to eke out moderate gains for the day, though this morning prices are printing in the red once again. Commitments from Saudi Aramco to boost production are weighing heavily on markets. Crude oil is currently trading at $61.55, down 70 cents (-1.1%) from Monday’s close.

Fuel prices are also sinking this morning. Diesel prices are trading at $2.0440, down 2.4 cents (-1.1%). Gasoline prices are currently trading well below $2/gal at $1.9585, a loss of 3.8 cents (-1.9%) since yesterday’s close.

US-China trade continues to be a concern for traders, though yesterday its affects were alleviated somewhat by focus on production cuts. Trade talks will continue this week, but US trade negotiators claimed yesterday that China had rolled back some previous commitments that substantially affected the nature of the deal. Although details of the commitment are unclear, Treasury Secretary Steven Mnuchin indicated the entire trade negotiation team was in alignment with ratcheting up tariffs to apply additional pressure. If tariffs do materialize on Friday, it would further limit trade flow between the two countries and hamper economic growth globally.

The IEA yesterday reported that 2018 renewables growth was flat with the previous year, the first time renewables growth has plateaued since 2001. While wind and bioenergy sources both saw continued growth in 2018, solar installations were flat, and hydroelectric solutions fell. Overall, the world installed 177 gigawatts of renewable energy last year, the same quantity added in 2017 and far behind the IEA’s projected 300 GW needed to meet long-term emission reductions.

California Outages cause Supply Tightness

Southern California fuel consumers continue taking a hard hit as refinery outages create supply concerns. For the second time in two months, the P66 refinery in Carson caught fire this past week. In addition, Valero’s 170 kbpd plant is offline; together, those two refineries account for 16% of California’s production according to Morgan Stanley. Looking at Los Angeles CARB diesel vs national diesel rates, prices differences have nearly doubled, and supply in the southwest (California and Arizona especially) has been extremely tight.

California is somewhat insulated from the rest of the world’s fuel trends for two reasons. First, their fuel specifications are quite unique, so California typically must produce all of its fuel locally or import from the few overseas refineries configured to produce CARB fuel. Second, fuel pipelines all flow from California to other states; no fuel pipelines flow into the state. These two factors make California’s supply situation quite unique. When a refinery goes down, there’s no back-up supply to fill in the gap. Conversely, when all refineries are operating at capacity and demand dips, prices can fall regardless of national trends. It’s an unusual fuel market, which unfortunately is dealing with a shortage now rather than a bounty.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.