IEA: US Oil Exports to Surpass Russian Exports by 2024

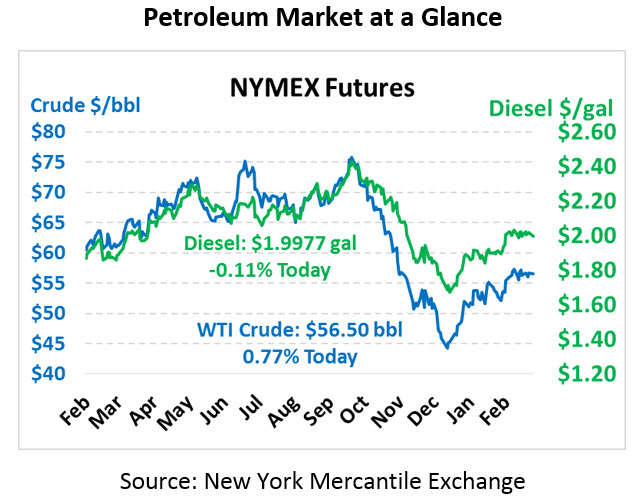

After a brief dip that saw prices fall nearly $2/bbl on Friday, oil climbed in the late afternoon to close with just small losses. This morning, prices are on the up mend as Saudi Arabia suggests OPEC will not consider changing output quotas at its April meeting. Crude oil is currently trading at $56.50, up 43 cents from Friday’s close.

Fuel prices also saw a large dip – to the tune of 5 cents – that narrowed by Friday’s close. This morning brings mixed price action. Diesel prices are trading at $1.9977 currently, down a few points from Friday’s close. Gasoline prices are trading at $1.8262, up 2.5 cents as we approach the spring demand season.

Saudi Arabian officials indicated that exports in April will be below 7 MMbpd, despite receiving nominations from customers of over 7.6 MMbpd. The supply gap will force customers to seek supply from other countries, contributing to a faster drawdown of global inventories. The kingdom also expects total production to be “well below” 10 MMbpd next month, below the 10.311 MMbpd OPEC production quota the country agreed to. The Saudis are demonstrating their resolve to balance oil markets and send oil prices higher – which is no surprise, given their requirement of $80/bbl crude to balance their government’s budget.

This week will bring a round of new reports yielding insights into February oil trends, as well as a look ahead to the rest of 2019. The IEA released their Oil 2019 report, which provides a medium-term look at oil markets. The report highlights the growth of US oil output, projecting that US oil exports will surpass Russian exports by 2024, making the US the second largest exporter at that time. Already, America is close to becoming a net exporter, and has achieved net exporter status in a couple recent weekly data reports. US oil production growth in 2024 is expected to be 4 MMbpd over 2018 levels – more than the next 5 fastest growers combined. The IEA, EIA, and OPEC will all be releasing their monthly market reports this week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.