IEA Releases New Market Report

This morning the IEA released their market report, highlighting both the ongoing economic recovery and the contrasting concerns over new virus variants. The IEA warns of a significant slowdown in demand recovery in the weeks to come due to unforeseen COVID-19 variant spread rates.

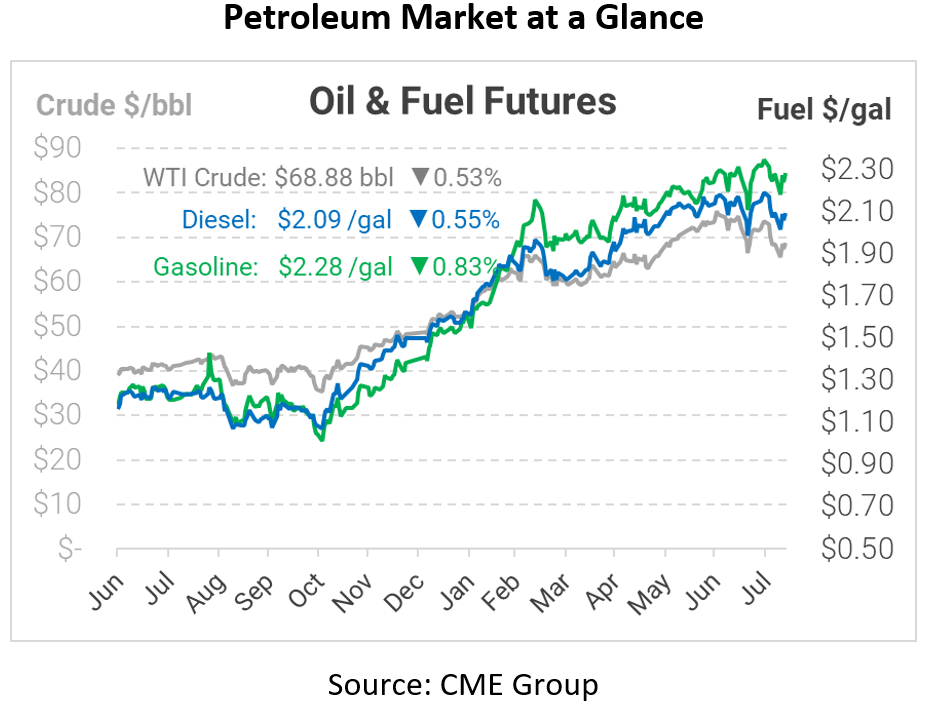

According to the IEA, global oil demand will rise 5.3 mb/d on average in 2021 from 2020’s suppressed levels. In July, we saw a deal finally reached with OPEC+ on what future production will look like. After this deal was reached, oil supply rose by 1.7 mb/d and is expected to grow steadily throughout the next few months. Unfortunately, just as the OPEC+ deal gave traders a sense of confidence in future outlooks, COVID-19 cases started rapidly rising as new variants were introduced worldwide. These cases put pressure on the market and saw fuel demand greatly affected. While the market seems never to catch a break, there is an expectation that this will not be another 2020 year of supply chain gloom.

Looking toward the next few weeks, many successful vaccination programs have already been implemented in the United States and Europe, yet many other countries are falling back to their COVID-19 restrictions, including travel and entertainment limitations. While there is still a fight ahead to stop the spread of the virus, there is much optimism around the idea that this will not be 2020 repeated.

This article is part of Daily Market News & Insights

Tagged: COVID, eia, fuel, production

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.