Ida Recovery Continues to Hit Oil Prices While New Threats Linger

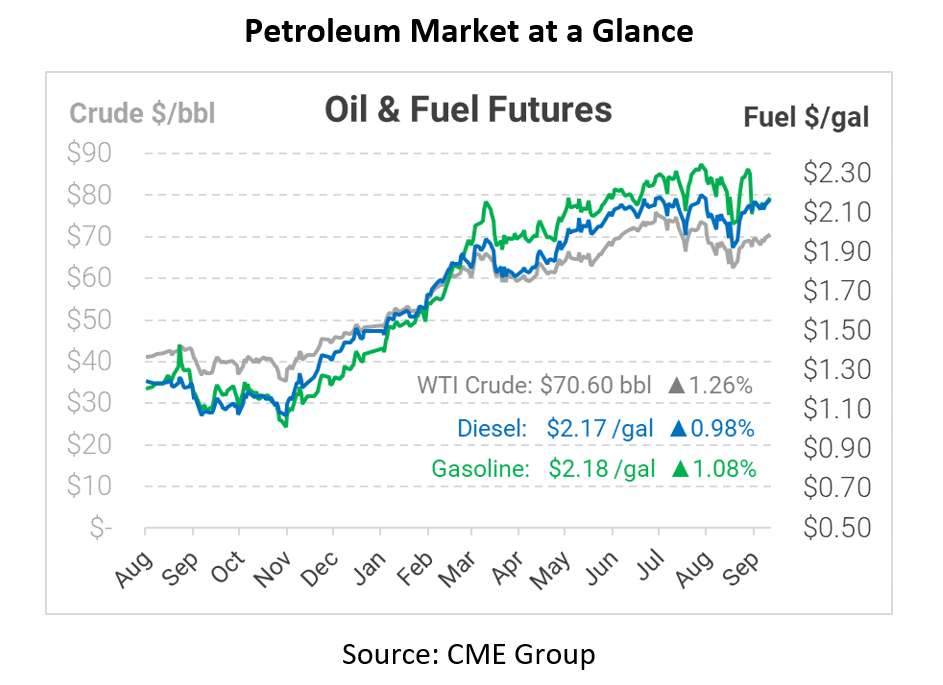

This morning crude opened at $70.55, up from Friday’s closing price. Diesel and gasoline followed the same upward trend this morning, with diesel opening at $2.1436 and gasoline at $2.1570. Today’s rise in prices comes after a continued fear of halted output due to Hurricane Ida clouds the market, with many suggesting it will take much longer than originally anticipated to get refineries completely back online.

According to Goldman Sachs, Ida has had a larger impact on oil production than on demand. This has created a downward impact on oil storages levels in the United States. New studies show Hurricane Ida caused almost 40 million barrels of oil production to be taken off the market. Today only three of nine refineries were completely shut down which accounts for around 7% of Gulf Coast oil refining. However, the setback still remains that many oil rigs are still shut in. The current crude demand impact from refineries is around 450,000 barrels per day, half of what it was last week.

More disruption to the market comes with more news of bad weather just around the corner. according to the U.S. National Hurricane Center (NHC), Tropical Storm Nicholas is currently in the Gulf of Mexico and could potentially be upgraded to a hurricane as early as tonight. Nicholas is a major flood threat to many coastal areas of Texas and Louisiana. New warnings have been issues by the Texas government as well as potential hurricane watch announcements. After landfall, Nicholas is expected to turn northeast and then east, leading it over parts of eastern Texas. From there it will head into Louisiana, where it is expected to be weakened to a tropical depression.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.