Ida Knocks Out Supply and Demand, Leaving Markets Neutral

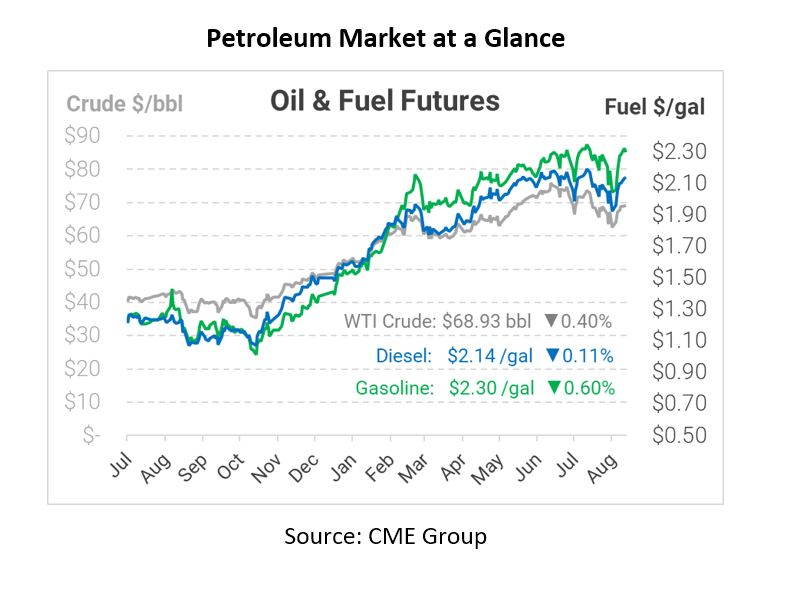

Although the morning opened with a steep selloff, prices have recovered most of those losses. Prices leaped higher as Hurricane Ida approached the Gulf Coast, but gains are subsiding slowly. After dropping $1/bbl this morning, crude oil has narrowed losses to just 30 cents, while fuel prices are less than 2 cents down.

Although refinery outages will cause local fuel prices to rise, the broader worldwide impact stems from those refineries not consuming crude oil, causing global demand (and therefore crude prices) to fall. Currently, the effect is 2 million barrels per day less crude demand (2% of global crude consumption). Of course, 95% of Gulf oil production (1.7 MMbpd) is offline, so the market’s net effect is neutral. Depending on which comes back online sooner, prices could leap up or down based on the imbalance.

In international news, all eyes are on OPEC+ and their meeting tomorrow to discuss future oil production. The group increased output in August to its highest level since April 2020, increasing by 200 kbpd – half of the expected increase due to pipeline issues in Nigeria and Libya. Today, the group is reviewing its 2021-22 forecast, which over the past few months has shown tight supplies in 2021 flipping to surpluses in 2022. Historically, OPEC+ has been satisfied with prices between $65-$85 internationally.

This article is part of Daily Market News & Insights

Tagged: crude, hurricane, Hurricane Ida, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.