Houston Channel Shutdown Distorts Inventory Data

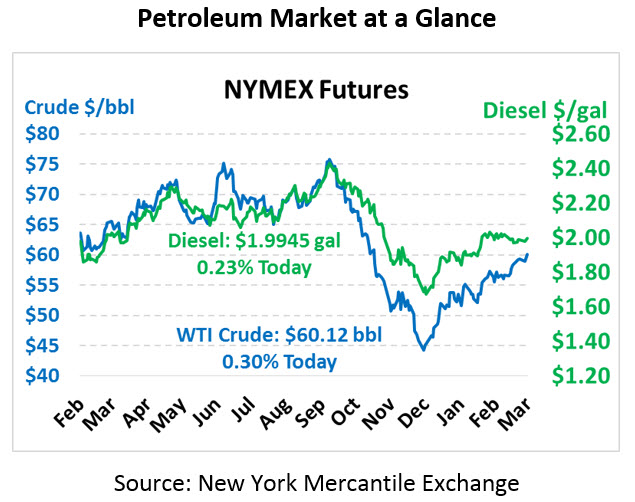

While oil has made a run above $60/bbl several times recently during intra-day trading, the product has yet to maintain that level heading into the close. Yesterday saw WTI close just pennies short of the $60/bbl threshold. This morning, crude oil is trading at $60.12, 18 cents above yesterday’s close.

Fuel prices are mixed, with diesel ebbing higher while gasoline gives up its recent steady gains. Diesel is currently trading at $1.9945, up half a cent from yesterday’s close. Gasoline prices are $1.9314, down 2.4 cents.

Yesterday the API released their weekly inventory data, which showed a surprise build of 1.9 million barrels for crude stocks, including a moderate build at Cushing. However, the API and EIA reports won’t hold quite as much weight as they usually do, given import/export limitations in Houston this week following the hazardous chemical spill. Today, over 80 ships have been blocked from coming or going from the Houston Ship Channel. Years ago, a blockage of the Houston channel would likely have yielded a strong draw in crude stocks, given our heavy reliance on imports. Today, the opposite is true – imports and exports are roughly balanced, with exports occasionally surpassing imports! For that reason, the shutdown could have a moderately bearish impact on oil, showing how far the US oil industry has come in just a few years.

In OPEC+ news, Russia has reaffirmed its commitment to reducing its oil outputs to the agreed upon levels. The country is targeting to achieve compliance by the end of this month. On the flip side, Nigerian exports have risen to new highs, up almost half a million barrels per day relative to February. Overall, OPEC and the additional countries cutting production have roughly achieved their production targets, with Saudi Arabia committing to go above and beyond to balance oil markets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.