Hope for OPEC+ and New Allies to Make Cuts

Yesterday, crude prices rose over 10% even in the face of bearish inventory data from the EIA. The major news moving markets yesterday was the likelihood of oil producers from around the globe contributing to supply cuts. Discussions to cut supplies include all the usual suspects of OPEC+ but also include players such as Brazil, Canada, Norway, and the US. Crude prices continue rising this morning on optimism that OPEC+ can come to some agreement as they meet this morning.

The legalities of the US contributing to supply cuts have come into question as price fixing is not legal in the US, but most of the cuts could come in the form of declines already produced by free markets. So far weekly EIA data shows production remaining near record-highs, but the EIA expects it to drop at least 0.5 MMbpd in 2020. According to Reuters, Exxon wrote a letter to the Texas RRC stating that it did not want to see cuts in Texas and preferred a free market solution.

In regional news, EIA data yesterday showed that PADD 2 and PADD 4 refiners had more days of supply than ever before. Supply was so high that for the first time in OPIS history some refiners have dropped finished E10 gasoline at the rack to less than 10 cents per gallon. Sub-dime gallons were found in North Dakota and dotting the Great Lakes, Great Plains, and Rocky Mountain markets.

Yesterday, weekly data on US inventories showed crude’s biggest weekly increase since 2016. The EIA reported a larger-than-expected build for crude of 15.2 MMbbls, versus an expected build of 9.3 MMbbls. At Cushing, the EIA reported a 6.4 MMbbls build. Despite overwhelming builds in other products, diesel remains largely unaffected by demand destruction, posting a meager 0.5-MMbbl build.

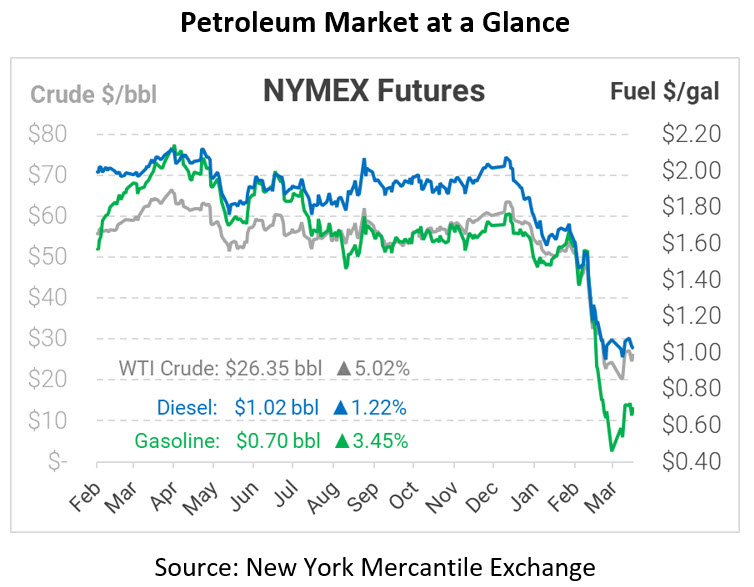

WTI Crude is trading higher this morning at $26.35, a gain of $1.26.

Fuel is up in early trading this morning. Diesel is trading at $1.0230, a gain of 1.2 cents. Gasoline is trading at $0.7014, a gain of 2.3 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.