Historical Look at Crude Oil

Editor’s Note: This article topic was requested by one of our subscribers. If you have a question you’d like answered by the FUELSNews team, feel free to email us at FUELSNews@mansfieldoil.com. We’re always happy to help out, whether you’re looking for a price forecast, a market analysis, or simply an explanation of industry jargon.

Yesterday, the FUELSNews team sent out a special fuel price update alerting readers that forward prices are beginning to show momentum higher, with prices surpassing $50 on Monday afternoon. The EIA updated their information on gasoline demand in May, setting a record at 4% higher than last year’s level. The strength in gasoline helped tow crude prices higher.

With so much talk about how crude prices have performed, it’s helpful to analyze historical trends to see where today’s fuel prices fit in. While it’s easy to compare fuel prices to their Feb 2016 lows of sub-$30/bbl prices, prices have trended much higher over the long-term – the 10-yr average price is approximately $79/bbl.

February 2016’s low price of $26.21 was the lowest price seen in the past ten years, with the only close period being the Great Recession crash in late 2008. Prices have nearly doubled since February 2016, with prices now hovering in the high-$40s.

In Q2 2017, prices fell below their 200-day moving average for the first time since early 2016, giving an opportunity for consumers to take a breather from high prices, and some consumers chose to take upward price risk off the table.

When looking at a 10-year seasonal graph of prices, it’s notable that crude prices reached their 10-year lows for June prices in 2017, hovering near $42/bbl. Even in 2016, which saw sub-$30 prices in February, prices had risen higher by June. Only in July did prices rise above all-time seasonal lows.

As you hear warnings of prices rising higher, let’s keep in mind that we’re still at historically low prices. Of course, every price increase hurts – if you consume a million gallons of fuel, and mere $.10 rise in prices will cost you $100,000. With that said, budgets are still benefiting from relatively low fuel prices.

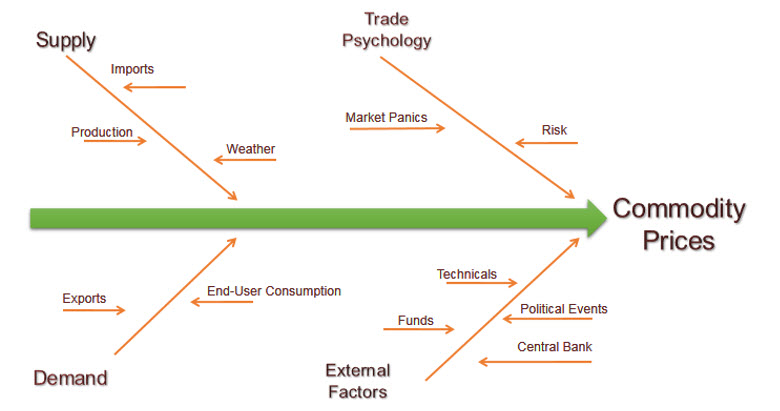

Low prices also mean asymmetric price risk. If fuel prices are around $2.00/gallon today, are they more likely to fall to $0.00, or to rise to $4.00? Of course, staying the same is also an option. No one can accurately predict fuel prices; if we could, we’d be out trading and making billions. We can only make our best guess (based on fundamentals and expert analysis) as to future prices. Most analysts expect prices to rise, but a surprise announcement from OPEC, an economic slowdown, or any of a number of other events could conceivably send prices spiraling down again. On the flip side, a terrorist attack, supply disruption, or pipeline outage could easily send crude prices back up above their 10-yr average.

Long story short, past performance is never an indicator of future results. While not a “random walk,” oil prices can be random at times, rising when fundamentals are bearish or falling when fundamentals are bullish. There are so many factors affecting oil prices that the precise direction and speed will never be known. Because no one knows where prices may go, it’s important that companies exposed to fuel price risk employ strategies to manage that risk, particularly while prices remain historically low.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.