Growing Libyan Supplies Stir Market Woes

On Tuesday, WTI crude closed down $1.31 (-3.2%). The return of nearly 300 kbpd from Libyan oil fields helped to push prices lower. The lifting of the Libyan blockade is currently only temporary – lasting until mid-October – until a final agreement is reached, but the effects of returning supply to the market is significant. As Libyan production rises, the key question will be OPEC+’s response. Markets are only balanced because the group is cutting 7.7 million barrels per day. As non-OPEC+ output rises, the group will have to decide whether to deepen their cuts or allow supply to outpace demand again. Crude prices are moving sideways in early trading this morning.

Demand concerns outweighed any bullish sentiment yesterday. Inventory news was mixed from the API yesterday afternoon. While crude and diesel had draws, traders seemed to focus on the build in gasoline. With the peak driving season in the US behind us, we can expect lower demand for gasoline in the coming months. The fear of a second wave of lockdowns in the US and Europe also have traders concerned about demand for products going into winter.

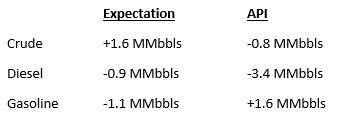

The API’s data last night:

The API reported a surprise draw for crude of 0.8 MMbbls versus an expected build of 1.6 MMbbls. At Cushing, stocks increased by 1.6 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had a surprise increase. The EIA will report numbers later this morning.

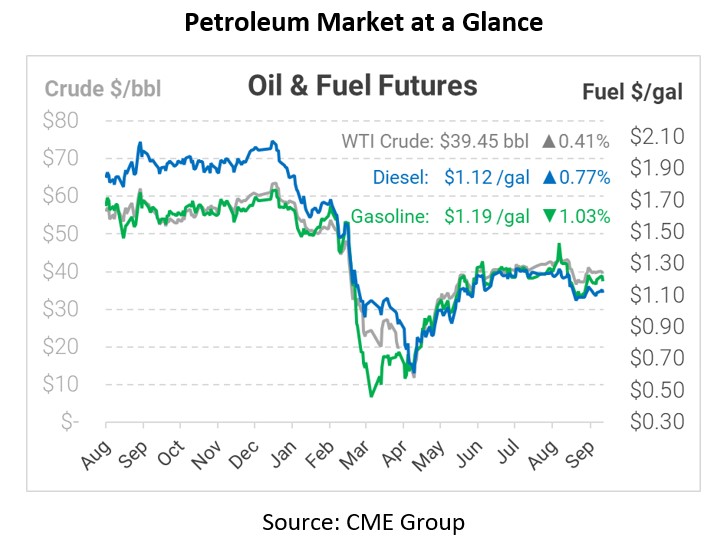

Crude prices are up this morning. WTI Crude is trading at $39.45, a gain of 16 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.1175, a gain of 0.9 cents. Gasoline is trading at $1.1893, a decrease of 1.2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.