Goldman Sachs Calls for Oil Rebound

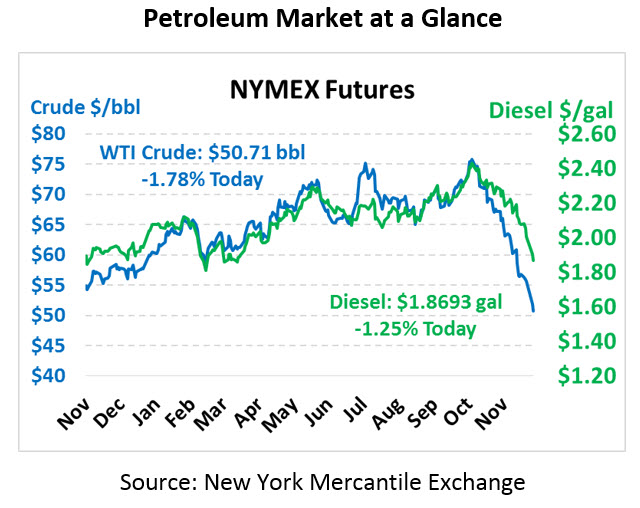

Yesterday’s uptick in prices was the largest gain oil markets have seen in months, but still only added $1.20 after prices lost some $6/bbl last week alone. The rally yesterday was likely short-covering after the long decline, though whether the market has bottomed out is anyone’s guess. Crude oil saw some early morning gains, but has since reverted substantially lower, trading at $50.71, after shedding 92 cents.

Fuel prices also turned a bit higher yesterday after some hefty losses last week. Diesel picked up just under 2 cents yesterday, and gasoline picked up a more sizable 5 cents after closing at its lowest point in two years. This morning, diesel prices are $1.8693, down 2.4 cents from Monday’s close. Gasoline is trading at $1.4119, down 3.1 cents.

Part of Friday’s sell-off was a response to Saudi Arabia increasing production in November by 500 kbpd compared to October. Back in October, the Saudis committed to a 500 kbpd decrease in December output – given the huge increase in November, their commitment will only get them back to October’s rate. Given that October’s production levels already created an oversupplied market, going back to a slightly less oversupplied market is underwhelming for traders.

Yesterday Goldman Sachs called for a rebound in commodity prices, identifying oil as an “extremely attractive” product for 2019. A couple weeks ago, Goldman’s head of commodities research Jeff Currie noted that the intense sell-off in crude is due to automated trading strategies and large hedge fund bets, not underlying fundamentals. Momentum trading strategies automatically short products that are losing money, driving the market even further down. When oil hit $55, it triggered numerous options that continued the selling. Now, with markets nearing the end of their technical plunge, traders will look back to the fundamentals – where OPEC’s supply cuts are dominating the narrative.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.