Goldman: “Oil Prices Could Be Higher for Much Longer”

According to Goldman Sachs, this price increase is far from over and will potentially be in the mix for many years to come. The multinational investment bank reiterated that because demand is rebounding, but supply remains tight, prices will continue to shoot up. Unlike the natural gas shortage, which is expected to be short-lived, Goldman Sachs warns that higher oil prices could last several years.

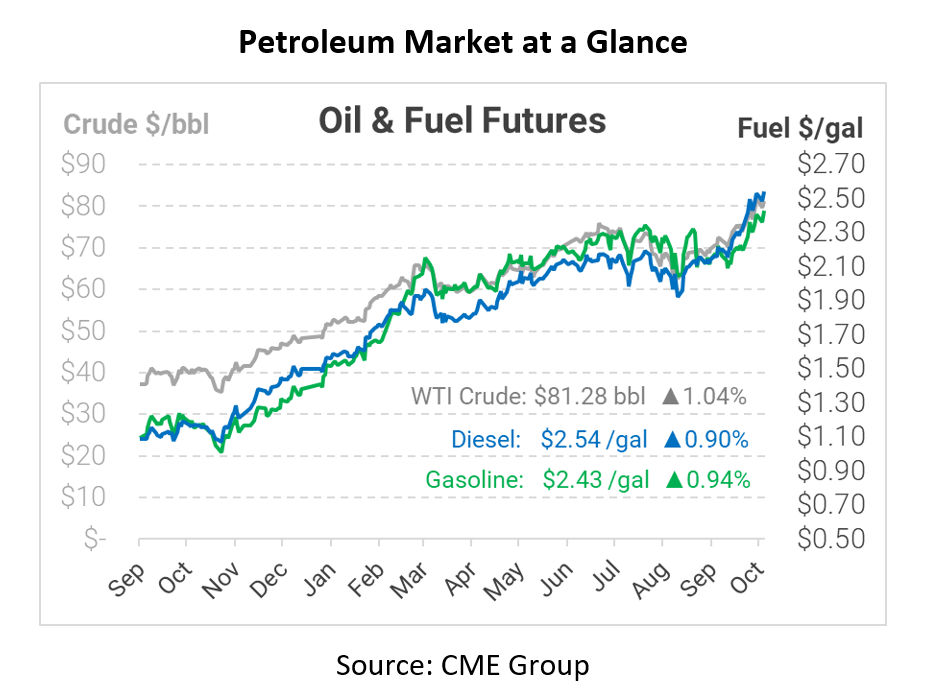

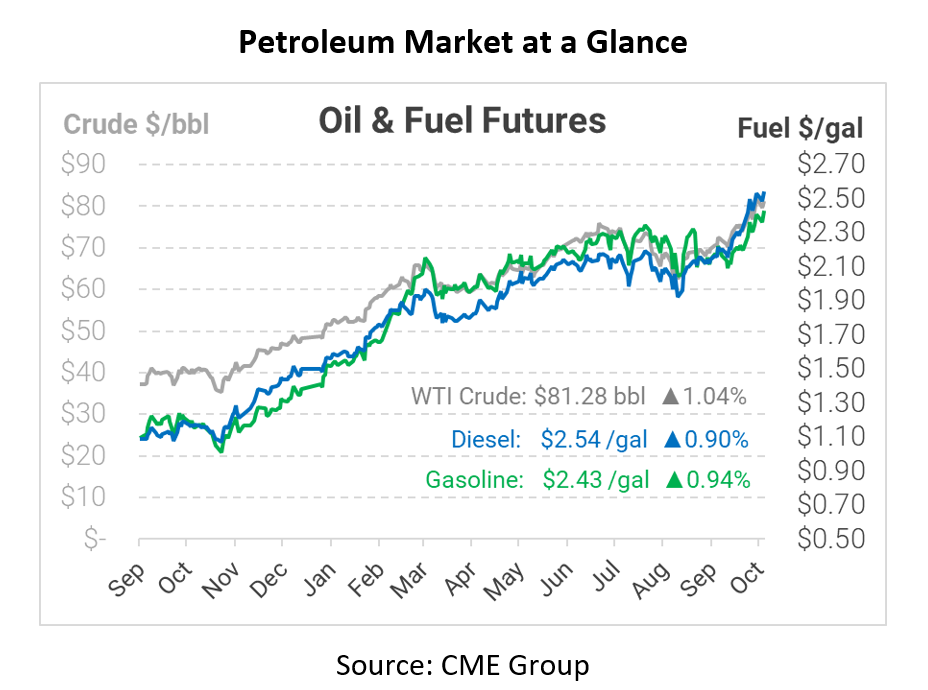

Some analysts believe that this is the start of a “repricing” period for oil, in which consumers will see the price of oil climb to at least $90 per barrel for a prolonged period. Oil has been producing trends that suggest we are in for a rough ride. The market is experiencing one of the most significant deficits in a decade, with more problems coming this winter. Demand will undoubtedly outweigh supply as we are preparing for one of the coldest winters in North America in recent memory. With oil drilling ramping up around the country, it still has not impacted the supply side of the curve like consumers want to see and will take a lot longer than just a few weeks to balance everything out.

Adding to short-term support, the International Energy Agency (IEA) reported that natural gas prices would boost oil demand. The IEA released their newest forecast, showing that they now expect total oil demand to reach 99.6 million barrels per day (bpd) in 2022.. Later today, we will also glance at the EIA inventory report, which will certainly impact price trends.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.