Gasoline Demand Recovering, Diesel Still Dismal

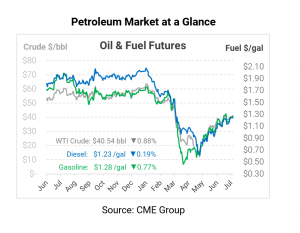

Wednesday’s EIA report helped break the market outside of its 5-cent range within which it has closed this week, but only just barely. Despite a headline build in crude inventories, the market ended the day roughly 30 cents higher – not even 1% up. After months of 5-10% daily swings, it’s remarkable how calm markets have become.

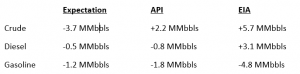

Yesterday’s EIA report was full of surprises, with crude inventories building far more than even the API projected, diesel stocks showing a surprise build, and gasoline drawing down by 4x the expected amount. Crude’s hefty build was concentrated in the Gulf Coast, where imports exploded week-over-week to a two-year high. While crude prices bucked expectations and moved higher, both gasoline and diesel reacted more predictably. Gasoline picked up 1.5 cents, while diesel fell by almost a penny.

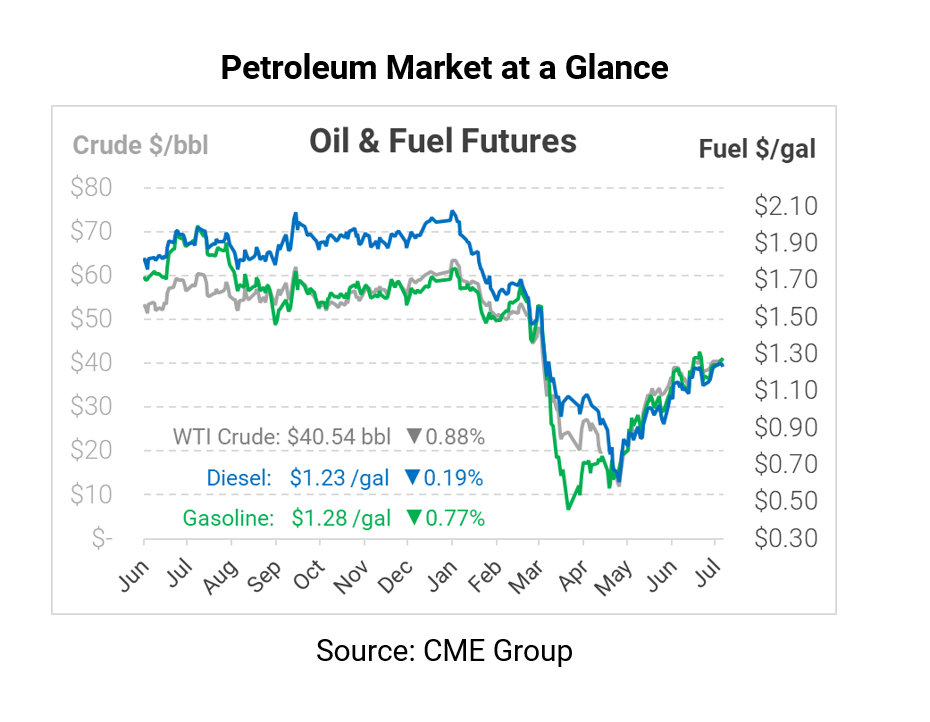

Markets were particularly glad to see gasoline inventories dropping for the week ending July 3 (note – right before the holiday). Gasoline demand rose by roughly 200 kbpd compared to the week prior, sustaining gains since spring’s collapse. Still, demand was just 8.8 MMbpd, roughly a million barrels per day off from summer 2019. But with refiners running at only 77.5% capacity, it seems markets have found a reasonable balance. Diesel demand, on the other hand, signaled a more bearish outlook; demand fell back by 750 kbpd versus last week to just 3 MMbpd.

This morning the market is turning lower as markets continue digesting yesterday’s report. Crude oil is trading at $40.54, down 36 cents from Wednesday’s closing price.

Fuel prices are also moving lower, pulled down by sinking crude prices. Gasoline is trading at $1.2809, down a penny from yesterday but now holding a commanding premium above diesel. Diesel is trading at just $1.2320, down 0.2 cents.

This article is part of Daily Market News & Insights

Tagged: diesel demand, eia, gasoline demand, Inventories

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.