Gasoline Briefly Dips Below $2/gal

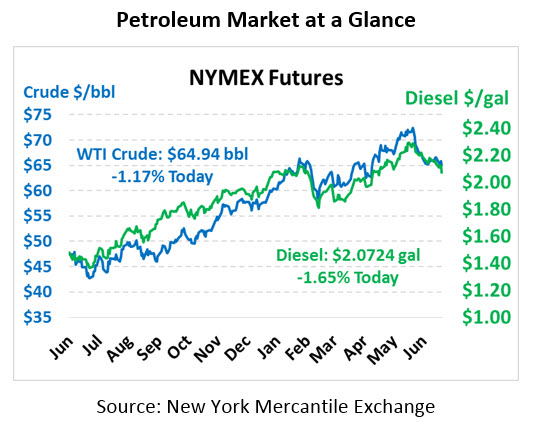

Yesterday’s brief market rally for crude oil reverted back to losses overnight. Crude closes yesterday above $66/bbl, but this morning prices fell back below $65/bbl as markets look towards tomorrow’s OPEC meeting. Prices will likely swing wildly today and tomorrow as brief snippets and comments from OPEC members are released. Crude oil is currently trading at $64.94, a loss of 77 cents since yesterday.

Fuel prices fell yesterday in response to inventory builds – diesel prices fell 1.5 cents while gasoline prices fell 1.4 cents. Losses are continuing today, particularly for diesel prices. Diesel hit a low of $2.0700 this morning, the lowest point since mid-April. Diesel prices are currently $2.0724, a loss of 3.5 cents (-1.7%) since yesterday’s close. Gasoline also hit a two-month low, dropping below $2/gal before rebounding slightly higher. Gasoline prices are currently $2.0071, a loss of 1.6 cents (-0.8%).

EIA Data

The big dip in fuel prices was attributable to the EIA data, which showed both gasoline and diesel stocks builds. Crude was the oddball in the report – showing a significant inventory draw. The draw was attributable to increases in refinery utilization, which rose 200 Kbpd this week. Export gains also outpaced import gains, helping to bring in extra supply for the U.S.

Gasoline in particular showed a large build of 3.3 million barrels, a large gain for mid-summer. Diesel inventories do tend to rise during the summer, so the distillate builds were not too surprising for markets. Diesel inventories have been very low relative to recent years, closer to the 2012-2015 average than to last year’s levels. Demand for both gasoline and diesel was down by almost half a million barrels per day a piece.

OPEC Deal

Markets are on edge about the results of tomorrow’s OPEC discussion. The group is deciding whether to increase production in response to lower production coming from Iran, Venezuela, and Libya. Saudi Arabia is pushing for a 1 million barrel per day increase, but other countries are opposed. Iran has been the most vocal opponent, saying OPEC should not give in to pressures imposed by Western countries. Some nations, such as Ecuador, have advocated a middle-of-the-road option, with production increases around 600 Kbpd. Media snippets throughout today and tomorrow will likely keep the market volatile until a firm decision is announced.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.