G20 Summit Provides Opportunity for Trade Talks

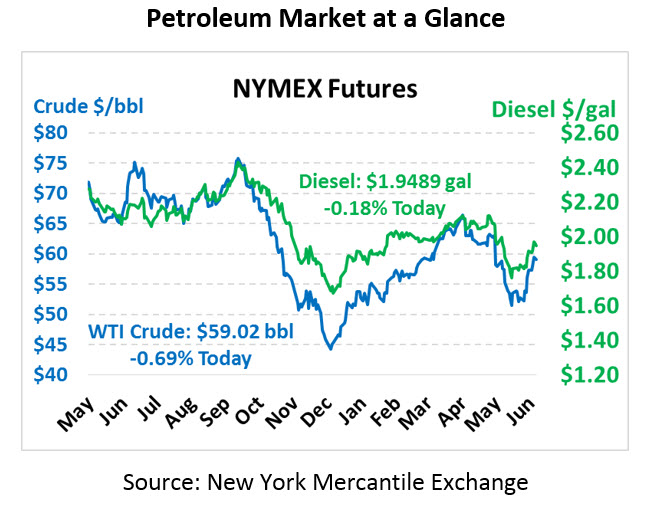

Oil is trading steady to slightly lower this morning as traders turn their attention to the G20 Summit in Osaka. After some early morning losses yesterday, crude rallied to end flat with Wednesday’s close. Today, crude is trading at $59.02, down 41 cents.

Fuel prices saw steeper losses yesterday, with diesel down 2 cents and gasoline down 2.4 cents. This morning, diesel is trading at $1.9489, down 0.4 cents. Gasoline is leading losses, trading at $1.9341 after shedding 1.3 cents.

Early in the week, the focus was on various supply issues ranging from Iran tensions to the closure of the Philadelphia Energy Solutions refinery. Now, the preeminent question is economic demand. President Trump and Chinese leader Xi are expected to meet this weekend to discuss trade, and possible outcomes range from positive progress towards tariff repeal to imposing tariffs on the remaining half of Chinese goods. Given dismal progress so far, markets will be happy with a slackening in trade tensions and resumed negotiations; a full resolution seems unlikely anytime soon. The G20 leaders will discuss other global issues including climate change, migration and cyber security, but no topic is expected to alter global affairs as much as trade will.

This week, WTI crude passed above the 200-day moving average for the first time since late May. The chart below shows the 200-day MA (blue) compared to WTI crude. Technical traders treat the 200-day moving average as an important momentum indicator – when prices peak above that line, its shows strong momentum higher. After prices broke through the 200-day moving average back in October 2018, they took five months to recover. With prices now moving higher, traders may view crude oil as a more attractive investment option and, therefore, drive the price higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.