Fuel Taxes Up in 7 States, Is Yours Included?

The FUELSNews team will be out tomorrow in observance of Independence Day. We will resume normal publications on Thursday, July 5.

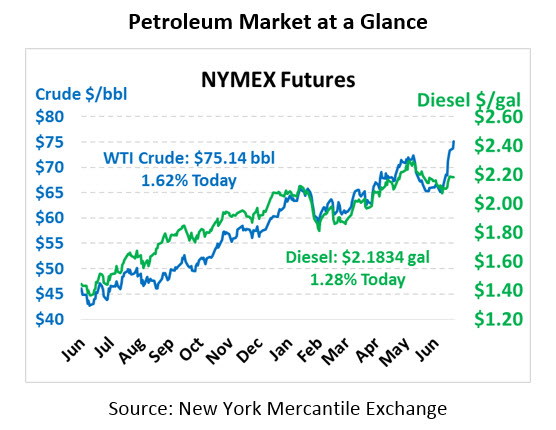

Oil prices are rising heading into a market holiday tomorrow, after crude gave up some small losses yesterday. Crude oil is currently trading at $75.14, a gain of $1.20 (1.6%). Once again, crude’s gains represent a multi-year high for crude oil – the first time WTI crude has trade above $75 since 2014.

Fuel prices fell precipitously yesterday after starting the day somewhat higher. Diesel prices fell by 5.4 cents (-2.4%), and gasoline prices fell a whopping 7.4 cents (-3.4%). This morning both prices are receiving support from rising crude prices. Diesel prices are trading at $2.1834, a gain of 2.8 cents (1.3%). Gasoline is at $2.1292, gaining 2.4 cents (1.2%).

Market moving news is generally light this morning. Markets are recovering from yesterday’s slight downturn, which was triggered by surveys showing that Saudi Arabian exports increased by 330 kbpd in June, while production rose 700 kbpd month-over-month. Russia also reported a production increase of 100 kbpd.

While Saudi Arabia and Russia have been increasing production, though, Libya has seen production fall by nearly 850 kbpd. Add that to the Canadian Syncrude outage of 350 kbpd we reported last week, and that’s over a million barrels per day off the market this month due to unforeseen shortages. Saudi Arabia and Russia increased production in response to the roughly 1 MMbpd of lost production from Iran and Venezuela, meaning they haven’t even begun to offset the more recent outages.

The shortage of supply is causing markets to bid up near-term prices – while prompt month (August) WTI crude is trading at $75.14, September WTI crude is trading at $72.71, more than $2.40 below August’s prices. A normal spread between two months is -50 cents to +50 cents for crude, occasionally straying a bit outside this level. A spread between prompt month and 2 months out below -$2.00 is extremely rare (occurring just 5 times in 2 decades) – showing the huge impact short-term outages are having on oil prices.

Fuel Taxes on the Rise

Although the federal fuel tax remains pegged at 18.4 cpg for gasoline and 24.4 cpg for diesel, states are able to change their fuel taxes at will, and several states took advantage of this fact to change their tax rates effective July 1.

Some of the tax increases are based on standard formulas considering some mixture of fuel prices, inflation, and government spending. These states include Indiana, Maryland, Vermont, and Nebraska. Nebraska’s formula actually led fuel taxes to decline slightly, though they remaining higher than taxes last year.

Conversely, some states signed legislation to increase taxes over time. For instance, South Carolina passed legislation last year increasing taxes slowly, with a total increase of 12 cpg as the goal. Tennesse did the same, phasing in an additional 6 cpg for gasoline and 10 cpg for diesel taxes.

Oklahoma and Iowa are the odd ducks in this round of increases. Oklahoma, which has not increased fuel taxes in over 30 years, upped gasoline taxes by 3 cents and diesel taxes by 6 cents. The tax dollars will go to funding transportation projects within the state, offsetting general fund money that will be put towards education to raise wages for teachers. Iowa’s tax increase applies only to gasoline sold without ethanol, which is an uncommon offering to consumers.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.