Fuel Prices Rising Faster Than Crude

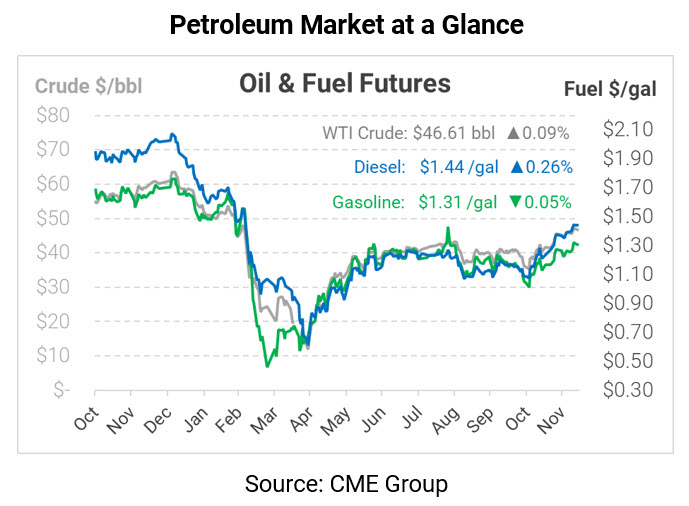

Oil prices are revisiting their nine-month highs after closing just slightly below their high on Friday afternoon. With vaccines finally being distributed in the world’s largest consumer market, fuel markets are getting a solid lift. In fact, rising consumer optimism is causing fuel prices to rise even faster than crude oil gains.

Fuel markets are slowly but steadily recovering from suppressed levels, suggesting an increase in refinery utilization and fuel inventories over the coming months. Typically, crack spreads (which show roughly how much a refinery can earn by converting 3 barrels of crude into 2 barrels of gasoline and 1 barrel of diesel) stay between $10 and $25, but prices have been suppressed below $10 since the COVID crisis began. The current 3-day streak of spreads surpassing $10 is the longest since August.

Crude prices recovered months ago, first surpassing $40/bbl then climbing to $45/bbl. During that time, fuel prices remained heavily suppressed due to low demand and high inventories. Now, fuel prices are beginning to catch up to crude’s rally. A rising 3:2:1 crack spread suggests that fuel prices are currently rising even faster than crude prices, which fuel buyers should watch carefully.

Of course, the best cure for high prices is high prices. As fuel price gains keep outpacing crude, refiners will ramp up utilization above the current level of 80%. Refinery utilization is typically at least 10 percentage points higher than current levels – suggesting there’s plenty of spare capacity once markets can absorb it. Rising prices incentivize more production, which fill inventories and in turn pushes prices lower again. This pattern will continue until refiners get back to 90-95% utilization and can no longer raise supply further. Keep an eye on refinery utilization – that will be the key metric for US fuel markets dictating when prices will return to pre-COVID levels.

This article is part of Daily Market News & Insights

Tagged: Crack Spreads, diesel, gasoline, Refinery Utilization

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.