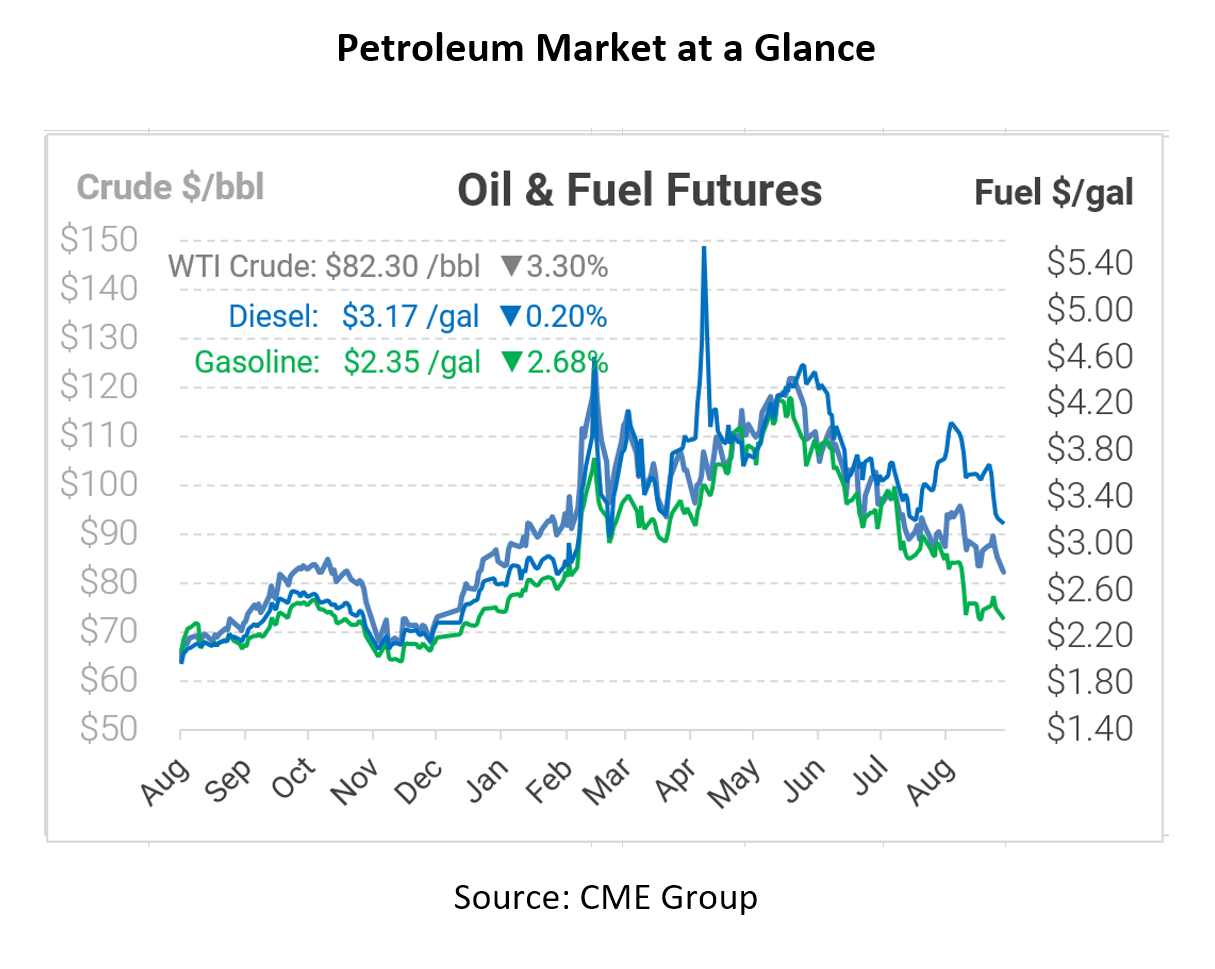

Fuel Prices Fall on Interest Rate Hike Expectations

Oil markets are trading lower this morning, bringing prices to the low end of their trading range from the past 6 months. Crude and gasoline are each within a couple percent of their 6-months lows, and diesel is trading at the lowest point since March. The market’s focal point is the Federal Reserve meeting on Wednesday, where Chairman Powell is expected to hike interest rates by .75%. Although August showed a small drop in inflation, the number was still above expectations. The Fed is expected to continue its aggressive hikes to curb growth and quell runaway inflation.

Along with expectations for higher interest rates comes changing forecasts for US growth. Higher interest rates make borrowing more expensive, which means less spending and demand. Goldman Sachs has increased its interest rate forecast, projecting 4.00-4.25% rates by the end of this year. At the same time, the bank has slashed its 2023 GDP forecast from 1.5% to 1.1% growth. With the world’s largest economy expected to grow slower than expected, oil prices are reacting with downward movements.

In global oil trends, the International Energy Agency released its monthly Oil Market Report for September, showing that demand will remain strong over the coming year thanks to natural gas-to-oil switching in some areas. At the same time, oil supplies are rising, reaching 101.3 MMbpd in August thanks to recovering production in Libya. Russia’s oil exports, which were down 0.6 MMbpd from pre-invasion levels, have stemmed losses to just 0.4 MMbpd. Of course, Europe’s full embargo in January is quickly approaching, which threatens to throw markets into chaos. OPEC+ won’t be much help – OPEC’s 10 members are producing 1.2 MMbpd less than quotas allow, and the non-OPEC members of OPEC+ are 2.2 MMbpd behind quotas. As markets weigh economic concerns against supply challenges, things seem to be roughly balanced for now, but winter heating demand could cause tightening over the next few months.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.