Fuel Market Falls as OPEC+ Considers Supply Increase

Fuel prices are trading lower this morning thanks to continued demand fears, even as the US is heading into one of the busiest travel periods of the season. AAA forecasts that 55 million Americans will hit the road this week to visit loved ones, just 2.5% below pre-pandemic travel levels. The majority will travel by car, while 4.5 million are expected to fly. AAA wants to expect severe congestion in metro areas including Atlanta, Chicago, NYC, and LA.

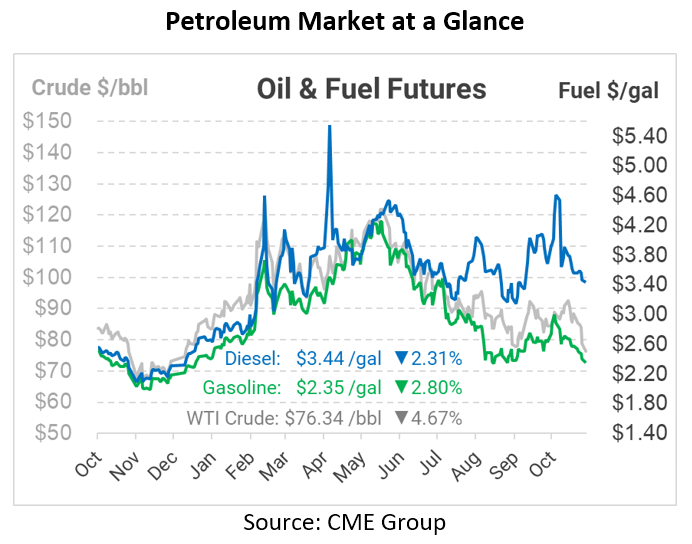

Despite a busy US holiday, markets are more concerned with the slowdown of activity in China. With COVID cases rising, many expect more restrictions to ramp down demand. At the same time, OPEC+ seems to be changing its tune. The Wall Street Journal reported in a headline that Saudi Arabia is considering a 500,000 barrel per day production increase at the Dec 4 meeting. Following the headline, oil prices sank, with diesel trading below $3.50. Diesel hasn’t closed below $3.50 since October 3.

The timing would put the increase the day before the EU’s embargoes go into effect on Russia. OPEC may be expecting some disruptions in global supply chains. Adding more production would ensure there’s oil close to European consumers, filling what could be a large supply gap in the region. At the same time, analysts expect more Russian oil to flow to India and China, so OPEC could lose ground with buyers in those areas.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.