Fuel Efficiency Freeze a Boon for Manufactures, Mixed for Consumers

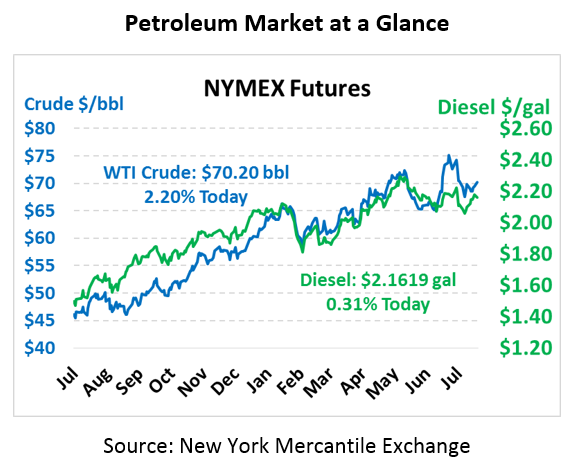

Markets are gathering steam following robust economic data in the US. Prices closed Friday lower, but saw growth over the weekend leading to today’s opening price of $69.01. This morning, WTI crude is trading at $70.20, a gain of $1.51 (2.2%) compared to Friday’s close.

Fuel prices are riding higher as well, though gains are far more muted. Diesel prices are currently $2.1619, a gain of 0.7 cents. Gasoline prices are slightly above diesel prices this morning, which is not unusual during the summer, trading at $2.1672, a gain of 0.5 cents.

Economic data released on Friday revealed that US GDP growth rose to 4.1% in Q2, the highest level since 2014, driven by consumer demand and trade growth. The latter factor may be somewhat surprising, but many believe exports surged higher as other countries rushed to buy products before tariffs take effect. Stock markets and oil both ended a bit lower on Friday as some had hoped for even higher growth. President Trump asserted that 4.1% was a historic economic turnaround and next quarter could see even faster growth; however, the Federal Reserve maintains its 2.8% forecast for 2018.

Just as oil markets were beginning to cool off from their geopolitical risk premiums (a big factor behind oil prices plummeting twice in June and July), fresh concerns last week in Saudi Arabia are continuing to add stress to the market. Saudi Arabia has ceased vessel transportation through the Bab el-Mandeb Strait, considered by the EIA to be the 4th largest oil chokepoint in the world, accounting for 5 million barrels per day of crude oil distribution. Tensions between Saudi Arabia and Iranian-backed Houthi rebels in Yemen are rising, and the Saudis have resumed their attacks on Yemen’s port city of Hodeidah.

Trump’s EPA Plan Could Increase Oil Prices while Lowering Vehicles Costs

In a move that’s good for car manufacturers but questionable for consumers, Trump’s administration proposed freezing vehicle mileage standards at the 2020 level of 37 mpg for US fuel consumption, rather than increasing standards to 47 mpg in 2020-2026.

Goldman Sachs estimates the move could add 500 kbpd of demand to forecasts in 2020 and beyond – which as we’ve noted in FUELSNews 360 corresponds with IMO 2020, which is already forecast to increase low-sulfur distillate demand. The one-two punch of higher maritime demand and higher transportation demand will almost certainly cause fuel prices to leap higher.

Lower fuel efficiency vehicles are a mixed bag for consumers. As noted above, the increased fuel demand will drive fuel prices higher, and without fuel efficiency gains drivers won’t benefit from less fuel consumption. On the flip side, less fuel efficient engines are cheaper to produce, meaning consumers will pay less for a new vehicles than they otherwise would have – to the tune of $2,000 according to the DOT. The DOT also forecasted an additional 13,000 road deaths if the higher fuel efficiency standards took place, because car manufacturers would have had to produce lighter (and thus more dangerous) vehicles to meet stricter standards. So there’s no clear answer on whether the policy change will be good or bad overall for consumers, but odds are good it will push prices higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.