Fourth Straight Crude Draw Outweighed by Surprise Gasoline Build

On Tuesday, WTI crude remained flat. This morning prices are lower as Congress struggles to agree upon a stimulus package. Also in the minds of investors, Trump postponed trade talks with China, which caused worry of increased tensions between the US and China.

In inventory news, the API reported that crude had a moderate draw for the fourth week in a row. Despite the draw, however, WTI crude is moving lower on news of a large surprise build in gasoline stocks. Should these numbers be confirmed by the EIA report later this morning, we may see steeper price declines as the session continues.

The market is waiting in anticipation for the OPEC+ meeting, which occurs today. Oil prices are at five-month highs, which would seem to indicate a recovery is underway. This month, however, both OPEC and the IEA lowered their demand forecasts for 2020. OPEC+ will have to analyse conflicting data to find the best path forward to balance markets.

The API’s data last night:

The API reported a larger-than-expected draw for crude of 4.3 MMbbls versus an expected draw of 2.7 MMbbls. At Cushing, stocks decreased by 0.6 MMbbls. The API reported that distillates had a decrease in stocks. Gasoline inventories had a large surprise build. The EIA will report numbers later this morning.

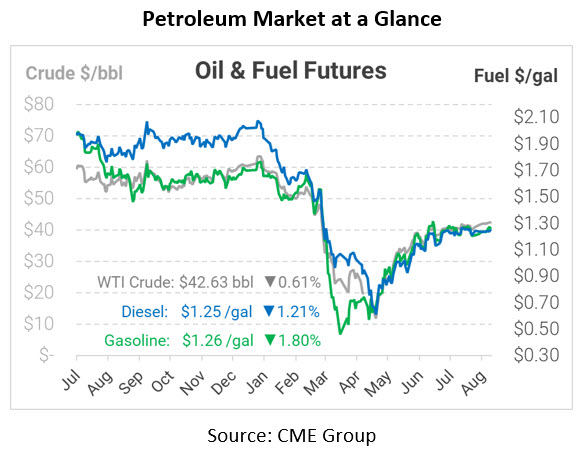

Crude prices are down this morning. WTI Crude is trading at $42.63, a loss of 26 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2451, a loss of 1.5 cents. Gasoline is trading at $1.2599, a decrease of 2.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.