Forecasts Project Active Hurricane Season

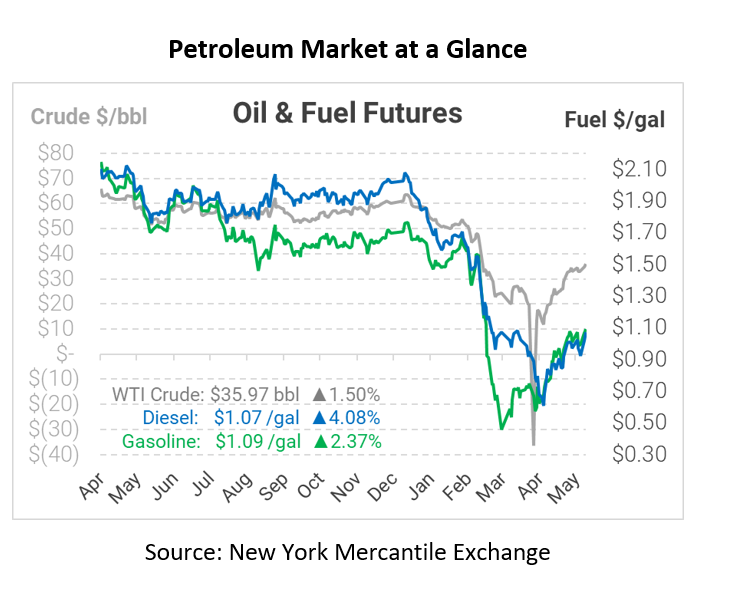

Yesterday, WTI crude ended flat with positive sentiment regarding production cuts capped by rising trade tensions between the US and China over security legislation in Hong Kong. Crude is trading near three-month highs this morning on expectations that OPEC+ will extend production cuts to bring down inventories. Saudi Arabia is in favor of extending current production cuts until year-end, while Russia wants to bring some production back online per the original OPEC+ agreement. OPEC+ may opt for a compromise, extending the nominal 9.7 MMbpd cuts by 2-3 more months.

Hurricane season officially started on Monday, but the third named storm is already stirring in the Gulf of Mexico. In line with the rest of 2020, the approaching hurricane season could be busy and complex. Forecasters are projecting an active tropical season in the Atlantic, with most forecasts showing an above-average number of hurricanes – more than six – for the season. NOAA projections call for a 70% likelihood of 13-19 named storms, of which 6-10 could become hurricanes, including 3-6 major hurricanes

In early trading today, crude prices are up. Crude is currently trading at $35.97, a gain of 53 cents.

Fuel prices are also up this morning. Diesel is trading at $1.0710, a gain of 4.2 cents. Gasoline is trading at $1.0920, a gain of 2.5 cents.

This article is part of Daily Market News & Insights

Tagged: Forecast, hurricane, opec, Russia, Saudi Arabia

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.