Fed Says Interest Rates near Neutral, Oil Rises

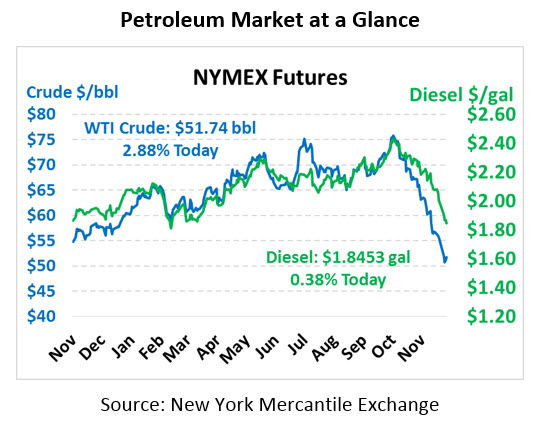

Oil prices keep testing the $50 price level, with prices this morning even briefly dropping below. But short covering and bargain buyers immediately prop the price back up above $50, revealing what seems to be a price floor. This morning crude oil is trading at $51.74, up $1.45 (2.9%) from yesterday’s close.

Fuel prices also tested new lows this morning before rebounding. Gasoline fell as low as $1.37 this morning, and diesel prices bounced off $1.81. This morning diesel prices are trading at $1.8453, gaining just 0.7 cents. Gasoline, on the other hand, is up 5.2 cents (3.7%) to $1.4494 thanks to yesterday’s reported draw.

The US dollar took a downward hit yesterday, providing some support to oil markets. Fed Chairman Jerome Powell noted that interest rates are near a neutral level – meaning the steady upward rise in interest rates could soon come to an end. Markets are expecting at least one more interest rate hike at the Fed’s December meeting, bring the total number of hikes this year to four. Currently, the Fed Funds rate is trading in a range of 2%-2.25%.

The EIA’s weekly petroleum data generally confirmed the API’s estimates, showing the tenth consecutive week of crude stocks builds and a surprise build for diesel inventories. The diesel build was particularly surprising given the nine consecutive weeks of stock draws, though diesel stocks do typically rise in late November and December. Thanksgiving travels helped keep steady pressure on gasoline stocks, causing a small draw last week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.