Fed Chairman Urges Congress for Stimulus Package

On Wednesday, WTI crude closed slightly higher but is trading sideways in early trading this morning. Despite the resoundingly bullish EIA report yesterday, markets failed to rise above $40/bbl. The dollar strengthened for the fifth day in a row as US equities fell and investors fled to cash. Yesterday’s flight to cash was triggered by voices from the Federal Reserve stating there was a need for more economic stimulus.

Republicans and Democrats have been gridlocked as negotiations faltered regarding another round of stimulus to support the weakened economy. While both sides agree that another injection of stimulus is needed, they disagree on how much should be spent. The latest bipartisan proposal to be introduced was a $1.5 trillion package that had the backing of the White House. In front of Congress on Wednesday, Fed Chairman Jerome Powell reiterated the efficacy of previous stimulus and urged congress to inject more cash into the economy. At this point, many expect that an agreement on a stimulus package before the November 3 election seems unlikely.

The EIA reported a decrease for crude of 1.6 MMbbls, versus an expected decrease of 2.3 MMbbls. At Cushing, the EIA reported that stocks were unchanged. US crude oil inventories are about 13% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 21% above the five-year average. Gasoline inventories had a draw and are about 1% above the five-year average.

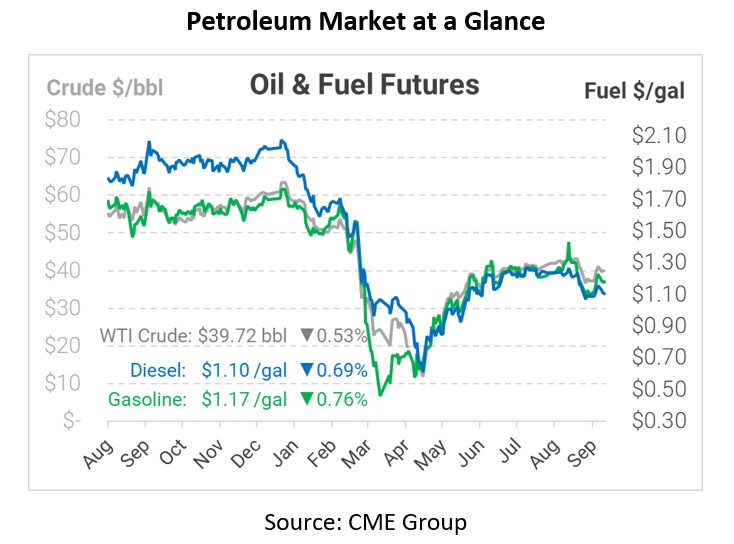

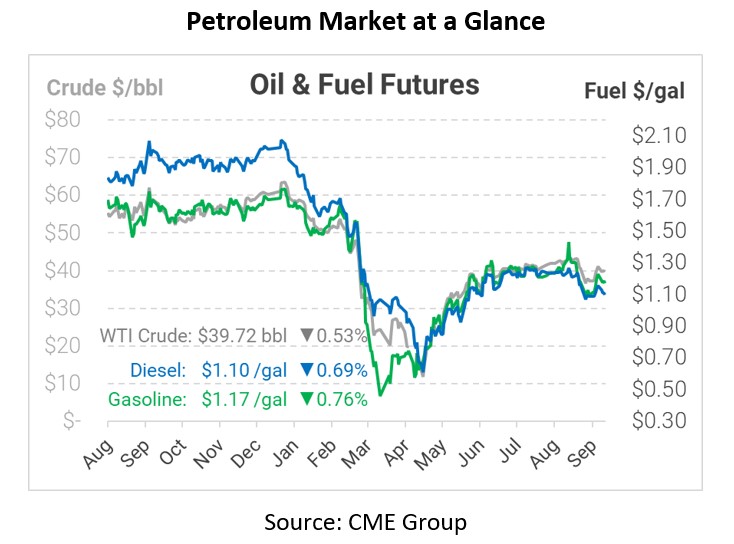

Crude prices are down this morning. WTI Crude is trading at $39.72, a loss of 21 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.0999, a loss of 0.8 cents. Gasoline is trading at $1.1723, a decrease of 0.9 cents.

This article is part of Daily Market News & Insights

Tagged: dollar, Federal Reserve, Jerome Powell, Stimulus

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.