Fed Chair Powell: Economic Future Highly Uncertain

After a strong finish yesterday, oil prices are suffering heavy losses stemming from a variety of headlines. On Wednesday, WTI Crude finished higher after bullish demand news and a mixed EIA inventory report that was bearish, but less so than this week’s API numbers. This morning, prices are retreating following an increase in COVID-19 cases – the second wave of infections could force many businesses to close again just after they reopened. Also, a gloomy forecast from the Fed regarding the pandemic’s effect on the US economy is dragging markets down.

On Wednesday, Fed Chairman Jerome Powell stated that the economic future is highly uncertain. He went on to say that while the May jobs report was a welcome surprise, many Americans will never go back to their previous jobs. Coronavirus could permanently change many parts of the economy, and Fed economists predict unemployment will remain elevated for several years. The honest forecast seems to have rattled investors as equity markets around the world responded with a downturn. The Fed signalled that it could keep rates at zero for years to come, and it would continue to use tools within its power to stimulate the economy.

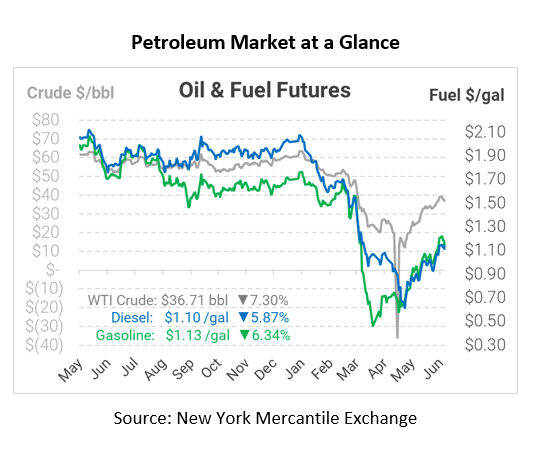

Crude prices are down this morning. WTI Crude is trading at $36.71, a loss of $2.89.

Fuel is down in early trading this morning. Diesel is trading at $1.1042, a loss of 6.9 cents. Gasoline is trading at $1.1332, a loss of 7.7 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.