Falling Inventories Not Enough to Influence Traders

On Wednesday, WTI crude closed lower despite new records set in US Equities and a bullish inventory report given by the EIA. The price decline came on the news from the EIA of falling gasoline demand which caused concern among traders of a slowing recovery. The report showed US gasoline demand last week fell to 8.78 MMbpd from 9.16 MMbpd the week before. The price decline is continuing in early trading this morning.

Traders seem to shrug off the bullish inventory news as having previously been priced in due to the Hurricane last week. The market seems to be expecting inventory builds in the coming weeks as production comes back on line from the storm. Inventory levels in the US had already been so high that production going offline hardly made a dent in prices. Distillates are hovering around 50 days of supply where in March they had been near 30 days of supply. Gasoline is around 27 days of supply coming down from near 50 days of supply in May.

The EIA reported a decrease for crude of 9.4 MMbbls, versus an expected decrease of 1.9 MMbbls. At Cushing, the EIA reported that stocks fell by 0.1 MMbbls. US crude oil inventories are about 14% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 23% above the five-year average. Gasoline inventories had a draw and are about 4% above the five-year average.

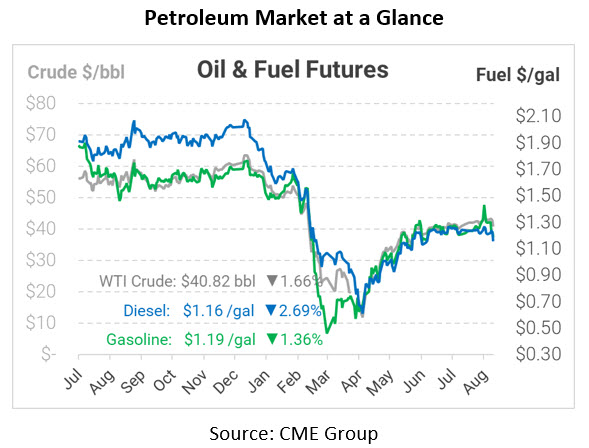

Crude prices are down this morning. WTI Crude is trading at $40.82, a loss of 69 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.1565, a loss of 3.2 cents. Gasoline is trading at $1.1856, a loss of 1.6 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.