EPA to Publish Renewable Obligations – What It Means for You

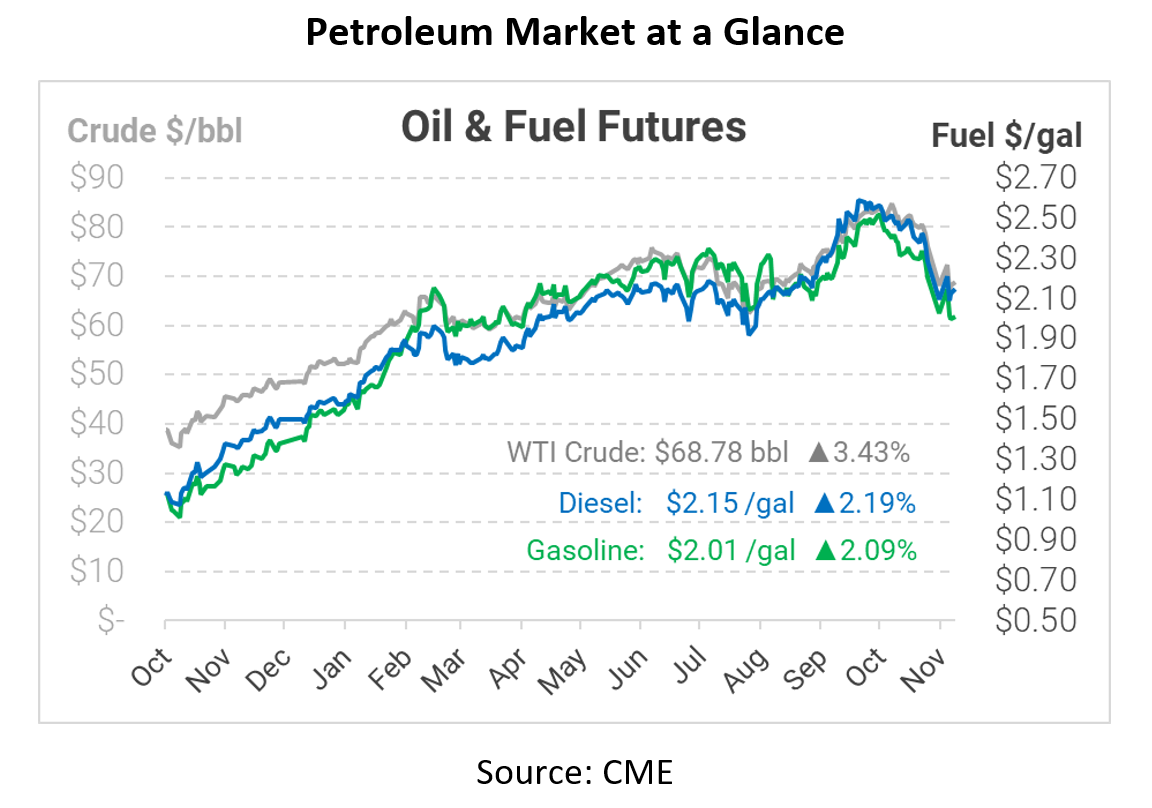

Oil prices went through a stall yesterday, jumping around only to end the day with minimal change. In contrast, prices are moving solidly higher this morning following President Biden’s announced COVID strategy and the OPEC+ decision. Fuel prices are up more than 5 cents per gallon this morning. But before we talk OPEC, let’s check in on what’s happening in the renewable fuel space.

The Biden administration is expected to release its renewable volume obligation in the next few days. The EPA has delayed publishing its requirements for 2020 and 2021, though leaked details suggest the agency will reduce the 2020 obligation from 20.1 billion gallons to 17.1 billion gallons, given pandemic challenges. Reuters reports that 2021’s obligation will be set at 18.6 billion, while 2022 will be a heftier 20.8 billion gallons.

Renewable volume obligations have a mixed impact on fuel markets and prices. Refiners argue that renewable requirements are costly, increasing the cost to consumers. When renewable fuels cost less than petroleum fuel, suppliers will naturally use them to keep prices competitive. Therefore, the mandate only forces suppliers to continue blending when renewable costs rise. While oil prices fluctuate based on OPEC production and other headlines, biofuels face volatility from changing feedstock costs and logistics constraints. Renewable fuel prices face significant fluctuations, and ethanol and biodiesel producers argue that volume obligations provide some certainty that helps them keep costs lower.

One factor favoring volume obligations is that renewable fuels are a big win for energy security. The required 20 billion gallons annually equates to 1.3 million barrels per day – over 6% of US fuel consumption. Without that mandate, American refiners would need to produce significantly more fuel, purchasing more crude from foreign sources to keep up.

All right, back to OPEC. The group choosing to produce more fuel would typically cause prices to fall, but traders are treating it as a vote of confidence in the market’s long-term prospects. Indeed, major banks have reported similar views. Goldman Sachs believes OPEC’s decision will keep more US shale on the sidelines, leading to a crunch in 2022 when OPEC runs out of spare capacity. The bank also believes low prices reduce pressure on President Biden to sign an Iran nuclear deal, which would add nearly 2 MMbpd to global markets. Morgan Stanley said Thursday that crude could be oversupplied for the next few months, flipping to undersupply by the second half of 2022. OPEC sources have also noted that the group could quickly amend its approach if Omicron causes a demand dip.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.