EIA Shows Tiny Crude Draw, Large Gas Build

Happy New Years! FUELSNews will resume publications on Wednesday, January 2. Have a Safe and Happy Holidays!

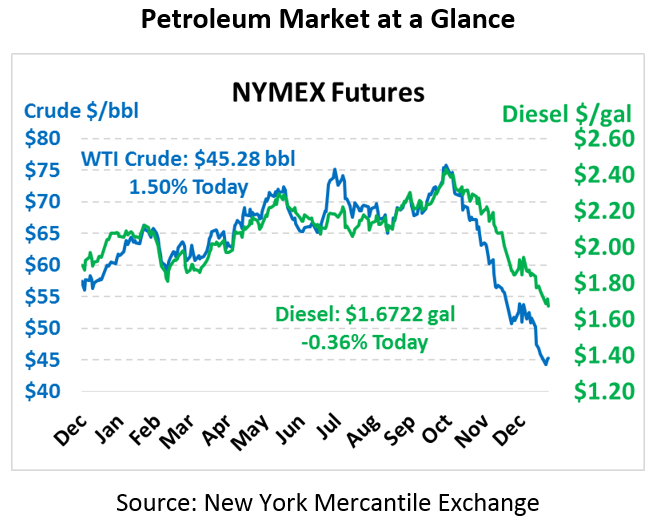

WTI crude is trading quietly this following, not treading far from Thursday’s close. Crude is currently trading at $45.28, up 67 cents (1.5%) from yesterday’s close.

Fuel prices are mixed this afternoon following the EIA’s report. Diesel prices are down 0.6 cents to $1.6722. Gasoline prices are $1.3114, up 0.7 cents.

Yesterday’s API report painted a very bearish picture, with crude stocks rising almost 7 million barrels…but the EIA’s data showed a more mild picture. Still, the EIA’s data disappointed relative to market expectations. Crude stocks fell gently, gasoline had a sizable build, and diesel stocks were virtually unmoved.

What the data hides is that all of crude’s draw came from the Gulf Coast via exports; in all other regions, crude stocks rose. The opposite was true for diesel – all regions saw distillate draws except the West Coast, where imports were above their normal levels. Refinery utilization ticked down a bit but remains strong for this time of year – keeping steady downward pressure on crude stocks while boosting fuel inventories. The market’s initial reaction to the EIA’s report was bearish, but the losses have turned to gains later in the day for everything except diesel.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.