EIA Shows Record Oil Exports, More Supply Tightening

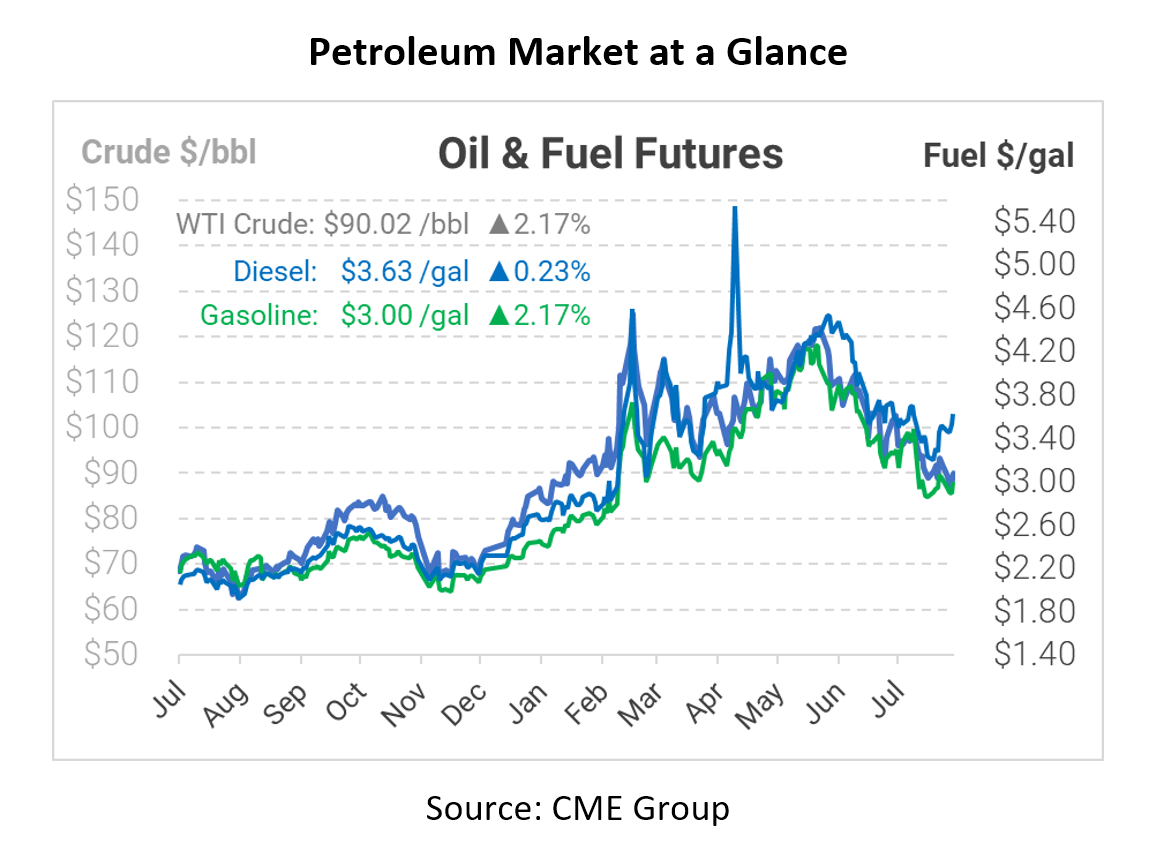

Yesterday’s EIA report left plenty for markets to unpack. Oil markets got a lift, with diesel prices leading the way. Export data got the most attention, with US exports rising to 5 million barrels per day – their highest point ever, and by a wide margin. The report shows that US crude is in high demand globally, with Europe taking the lion share of the increase.

Beyond high exports, the report also showed steep withdrawals for most oil product inventories. Crude oil fell 7 million barrels, while gasoline fell 4.6 million barrels. Although diesel posted a meager 0.8-million-barrel increase this week, markets were unimpressed: diesel prices rose 13 cents yesterday, compared to gasoline’s 3-cent gain.

On the demand front, gasoline was above 9 MMbpd once again, reversing earlier EIA reports showing very low summer demand that industry sources had discounted. In fact, the 9.35 MMbpd demand number was the second-highest this year, suggesting that drivers are in fact still hitting the roads.

While demand is strong, refinery output may take a hit in the coming weeks. Utilization fell from 94.3% to 93.5%, and OPIS reports that we could see a higher than usual refinery turnaround time this fall. Many refineries delayed downtime earlier this year when crack spreads rose to record highs; now, they’ll need to catch up to ensure equipment is operating safely. Pair that with hurricane season and tight inventories, and we could certainly see some tight markets this fall!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.