EIA Shows Large Diesel Build, Prices Still Rallying

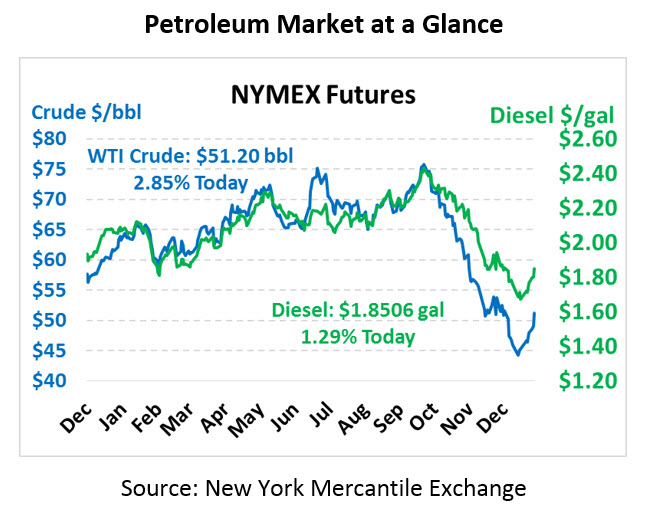

One week into 2019, oil prices are rising rapidly. WTI picked up $1.25 yesterday, bring total gains since Jan 2 to $5.40 as of this morning. WTI crude is currently trading at $51.20, up $1.42 (2.6%) from yesterday’s close.

Fuel prices are keeping track, with gasoline briefly surpassing the $1.40 threshold for the first time since mid-December. Diesel prices are currently trading at $1.8506, up 2.4 cents (1.3%). Gasoline prices are $1.3970, a gain of 3.4 cents (2.5%).

Market optimism is rising as US-China trade talks are apparently gathering steam. Expected to last two days, the trade talks were extended to a third day, with meetings concluding this morning. Both countries are expected to release a message on trade progress tomorrow morning. The US has been pushing for China to purchase more American products, lowering our trade deficit and leveling the playing field for American companies.

In India, refiners are beginning to make payments in rupees for deliveries of Iranian oil. Given the prominence of the “Petrodollar” (nearly all oil, regardless of which countries are buying or selling, is traded in US Dollars), the move is quite a snub to the dollar. Following America’s sanctions on Iran in November, the country cannot use US dollars to trade its oil, forcing them to rely on special payment mechanisms with various countries.

India is expected to request an additional waiver once its current 6-month waiver expires; even without waivers, some Indian refineries may choose to continue doing business with Iran given Iran’s commitment of free shipping and generous credit terms. If India does continue buying Iran’s oil, it could increase the overall supply available to the market, a bearish trend for prices.

EIA Report

The EIA released their weekly data this morning, which directionally aligned with the API’s report, but with a more bearish slant. Where the API reported a sizable crude draw, the EIA showed a smaller than anticipated draw. Gasoline’s build was smaller than the API forecast, but diesel’s build was almost double the API’s data and 5X the market’s expectation.

For diesel in particular, the lofty build has reflected in product prices locally. While the NYMEX HO prices continue rising, regional diesel basis levels have fallen, particularly in the Gulf Coast, where basis fell from -15¢ to -33.5¢ over the last few weeks (recall that Basis is the difference between NYMEX prices and regional cash prices). Although diesel stocks are still below the 5-year average, diesel supplies are more relaxed now than they were during the summer of 2018, easing some of the price pressure seen in the market recently.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.