EIA Shows Continued TX Storm Effect

Oil prices are climbing higher this morning as the US moves closer to passing stimulus legislation. Yesterday, the House of Representatives gave final approval, and President Biden is expected to sign the bill on Friday. With more money trickling through the economy and more vaccines available, markets are expecting a wave of summer fuel demand to lift prices.

Markets were shaken by the EIA’s report yesterday, with crude oil shedding $1/bbl and fuel dropping 2 cents immediately after the release. By noon, they had recovered the full amount. Perhaps responding instinctively to the large crude draw, some reflection showed that refining utilization remains suppressed. The flip side of the crude oil build includes hefty draws from product inventories. Both diesel and gasoline fell sharply for the second week in a row.

Refinery utilization recovered by 13 percentage points, yet numbers are still worse than those during the worst hurricane events in history. Refinery utilization is currently 69%, a level seen only a handful of times in US history. Crude inputs went up, but remain 2.5 MMbpd below pre-storm levels. That equates to over 100 million gallons of fuel offline – roughly 13,000 full truckloads of fuel.

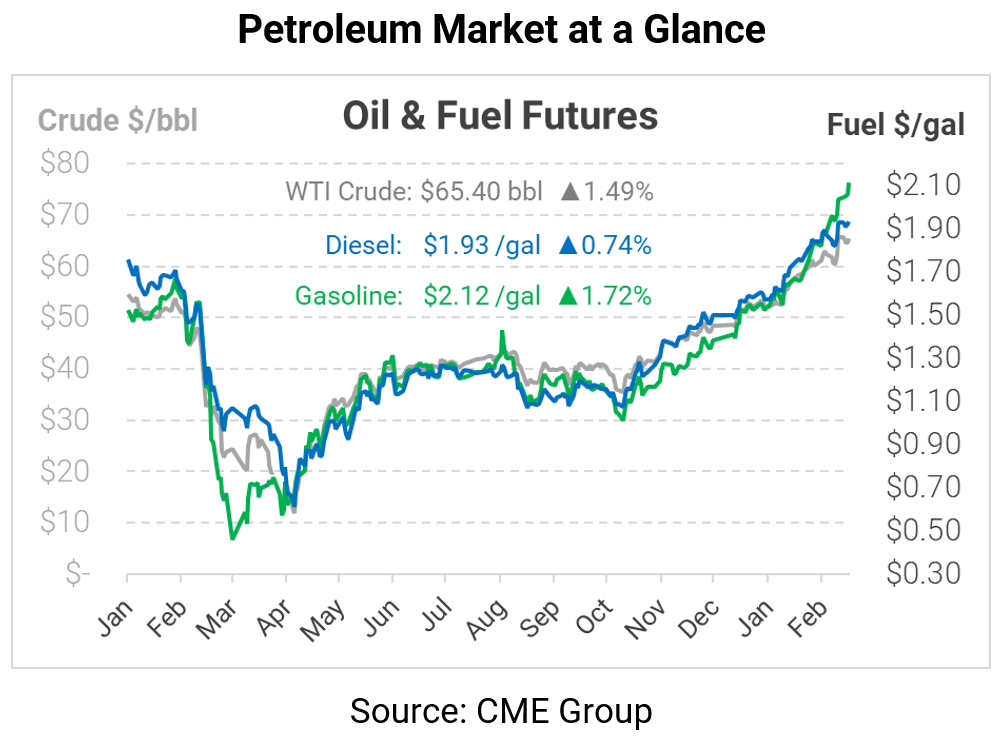

Crude oil is trading nearly a dollar higher this morning, supported by the stimulus legislation and OPEC cuts. WTI crude is currently trading at $65.40, up 96 cents (+1.5%).

Fuel prices are also soaring higher. Diesel is trading at $1.9314, up 1.4 cents (+0.7%) from Wednesday’s closing price. Gasoline is currently $2.1153, up 3.6 cents (+1.7%).

This article is part of Daily Market News & Insights

Tagged: Inventories, Refinery Utilization, Winter Storm

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.