EIA Reports Tight Market & Slowing US Oil Output

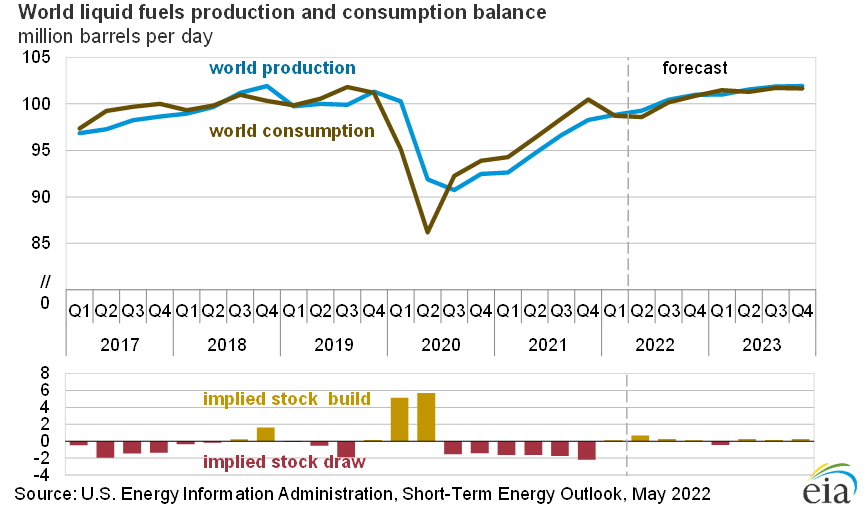

Yesterday the EIA released its monthly Short-Term Energy Outlook, or STEO, to provide guidance on energy market fundamentals. Notably, the agency revised total world oil production down by .5 million barrels per day (MMbpd) compared to their April report, leaving demand mostly unchanged. The downward revision comes mainly from reduced Russian output, which they reported falling more than expected in April. They also cut the projected output from US producers, showing production rising 100 kbpd slower than April’s report.

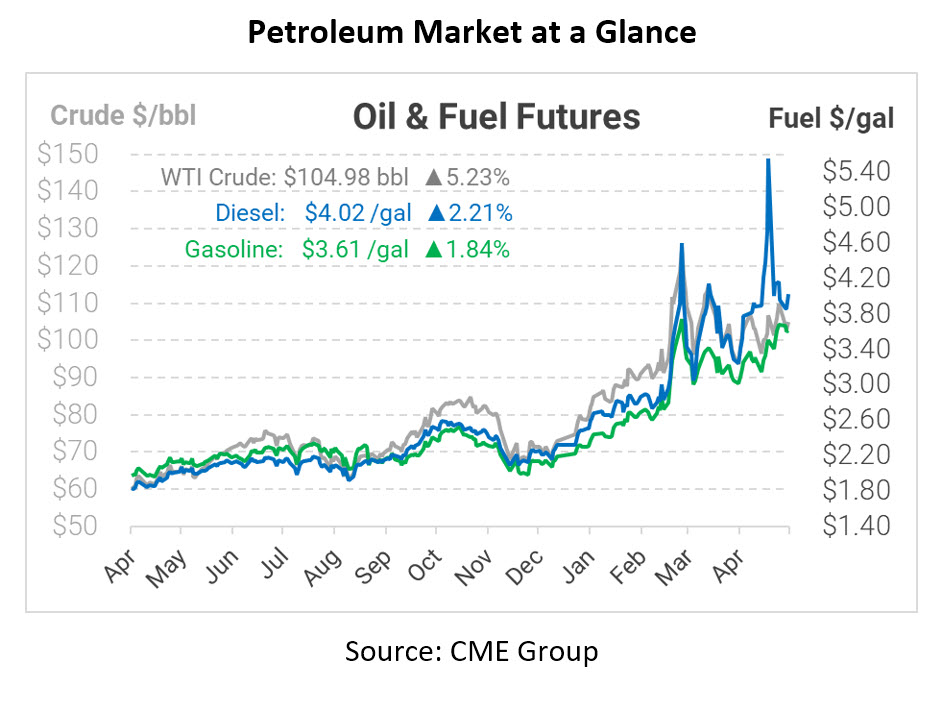

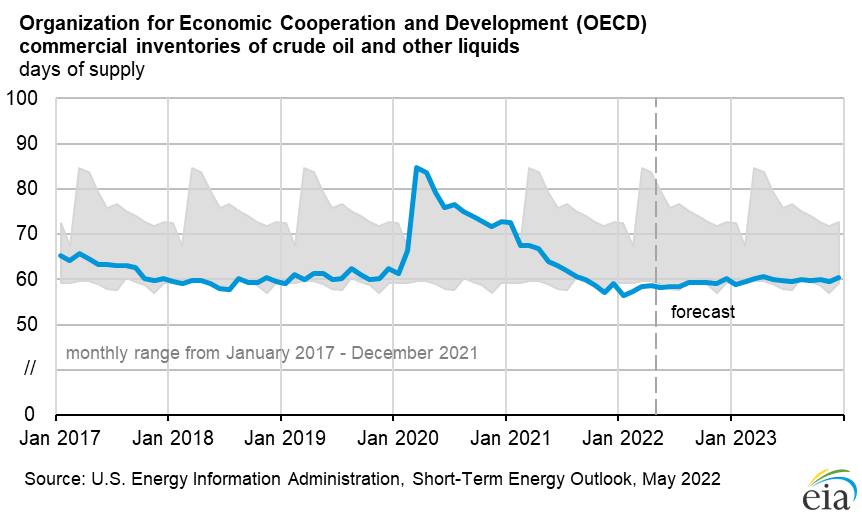

Declining production is certainly the headline impacting markets today, with prices ticking higher once again. Still, the report is not all bad news. The EIA’s analysis shows markets relatively balanced for the next two years, with supply and demand moving closely together. They also project global oil inventories moving into the low end of the 5-year range by 2023, though stocks are still below the historical level now. The EIA estimates that the developed world has around 2.63 billion barrels in inventory, up slightly from February’s eight-year low. Overall, the agency expects WTI crude oil to trade at $98.20 this year, falling to $93.24 next year.

The one drawback of the EIA’s report is that their reporting methodology does not allow them to speculate on future market events – something that’s particularly challenging right now. Although the EU has announced a potential ban on all Russian crude oil, the rules are not official yet, so those are not included in the EIA’s forecast. A complete ban on Russian crude oil would substantially curtail Russia’s oil output, leading the market to a much more severe imbalance than reported here.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.