EIA Reports Record-Shattering Trends

Oil prices are gaining ground this morning, building on yesterday’s rally that was triggered by the EIA’s record-shattering report. Over the past two trading sessions, oil prices have gone up nearly $3/bbl, while fuel prices are up by 4-5 cents. Today, OPEC will reveal their production strategy for the next few months, keeping some mystery hanging over the market. Adding to bullish sentiments, Congress is inching closer and closer to a stimulus deal that would speed up vaccinations and put money in the hands of consumers.

The EIA released their weekly inventory report, revealing the extent of the damage from the winter storm. In addition to rapidly growing crude inventories, refined products saw huge cuts to inventories. Diesel inventories fell by almost 10 million barrels, while gasoline was down an astounding 13.6 million barrels.

Numerous records were shattered in the report, including the largest crude build in history and a record low refinery utilization rate. Of course, record-breaking inventory trends have become the norm; out of the top ten largest crude builds, six occurred within the last year. For refinery utilization, eight of the top ten lowest utilization rates ever occurred within the last year, and two in the last two weeks! The second lowest utilization rate occurred when Hurricane Ike combined with a global recession to wreck demand and refinery operating capabilities at the same time.

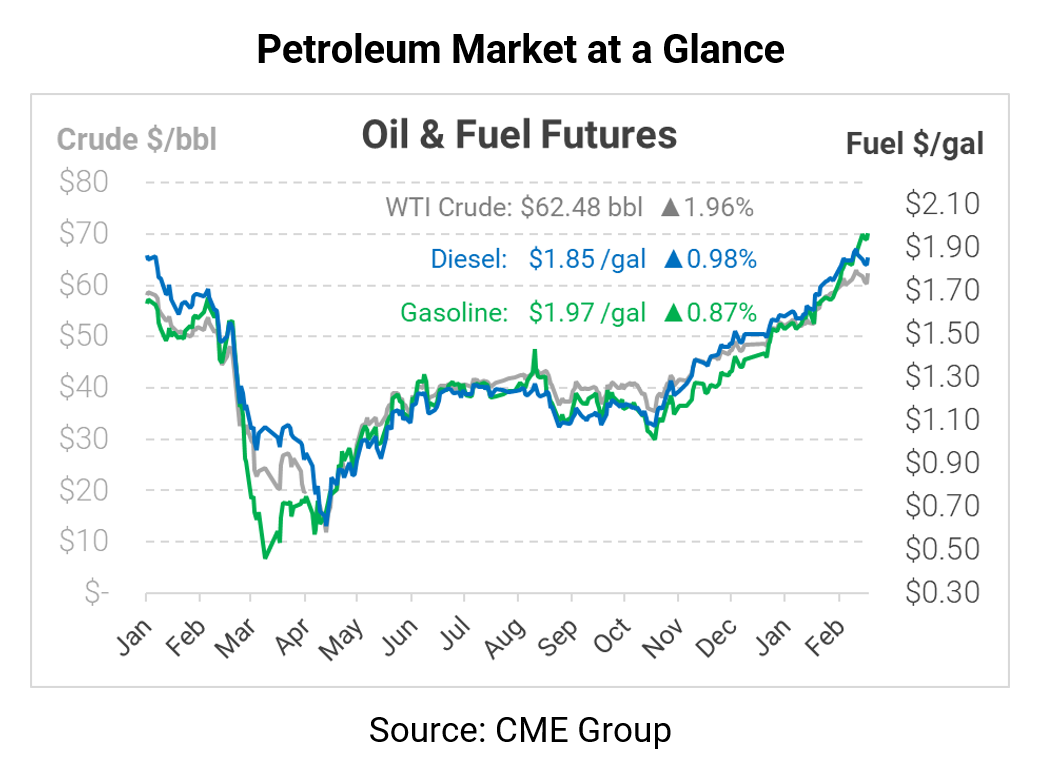

After a slow start this morning, oil prices are beginning to take off once again. Crude oil is trading at $62.48, up $1.20 per barrel.

Fuel prices also continue climbing. Diesel is trading at $1.8536, up 1.8 cents from Wednesday’s closing price. Gasoline prices are $1.9688 currently, up 1.7 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.