EIA Report Triggers Crude Sell-Off, Markets Eye Fed Summit

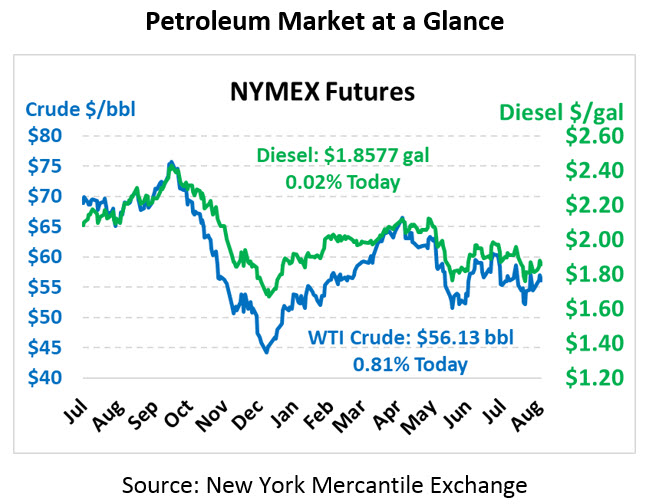

The EIA’s report failed to drive enthusiasm for markets yesterday, triggering a decline of nearly a dollar for crude oil prices, though fuel prices ended the day higher. This morning, crude is recouping some of the losses, while fuel prices remain higher. WTI crude is currently trading at $56.13, up 45 cents from Wednesday’s close.

Fuel prices are also up, sustaining yesterday’s small. Diesel prices are currently $$1.8577, flat with yesterday’s prices. Gasoline is trading at $$1.6968, up a meager 0.3 cents.

The EIA’s data was roughly in line with market expectations, though diesel inventories did surprise to the upside a bit with a 2.6-million-barrel build. Crude inventories fell more than expected, down 2.7 million barrels – but this drop was less than the API’s report, so markets were unimpressed. For WTI crude specifically, which is priced based on Cushing OK deliveries, a hefty Cushing draw of 2.5 million barrels should provide some upward price support for the week. Refinery runs crept higher, up to 95.9% for the week, and crude inputs rose 2.3% to 17.7 million barrels per day. That crude input level isn’t exactly a record but does make the top 10 list of all-time highest crude inputs.

Economic news continues to play a dominant role in keeping prices lower. This week, several foreign central bankers and financial ministers are gathered in Jackson Hole, Wyoming to evaluate the global economy. US Federal Reserve Chairman Jerome Powell is speaking tomorrow, and investors will be hanging on his every word to determine whether the Fed will continue cutting interest rates in the coming months.

As an aside, it’s worth noting that when searching “Jackson Hole,” out of the 482 million results, the first story details a Bison hit-and-run event caught on tape, with subsequent articles related to the global financial summit. Good to see the internet has its priorities in line.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.