EIA Raises 2021 Forecast for WTI

WTI crude closed lower yesterday on news of a growing number of coronavirus cases in China and more stringent lockdown measures and restrictions in Europe. The market continues to feel downward pressure as the EIA reports builds in products from last week.

In the EIA Short Term Energy Outlook (STEO) for January, the EIA forecasts a rise in the average spot price for WTI crude to $49.70/bbl for 2021. The price is an increase from the December STEO price of $45.78/bbl for 2021. The EIA estimates that the global consumption of petroleum and products averaged 92.2 MMbpd during 2020, which was down 9.0 MMbpd from 2019 figures. The EIA expects global liquid fuel consumption to grow by 5.6 MMbpd in 2021 and by 3.3 MMbpd in 2022.

The EIA noted that the January STEO is subject to increased levels of uncertainty because the response to the coronavirus continues to evolve. “The ongoing pandemic and the success of vaccination programs will continue to affect energy use in the future,” the EIA said in its latest STEO.

The EIA reported a larger-than-expected draw for crude of 3.2 MMbbls, compared to an expected decrease of 2.3 MMbbls. At Cushing, the EIA reported that stocks decreased by 2.0 MMbbls. US crude oil inventories are about 8% above the five-year average for this time of year. Distillates reported a build and continue to trend roughly 9% above the five-year average. Gasoline inventories had a build and are about 1% above the five-year average.

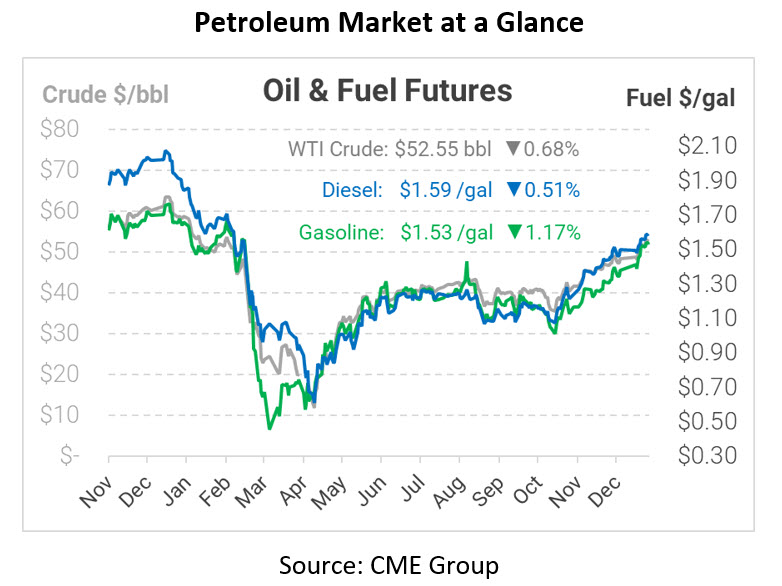

Crude prices are down this morning. WTI Crude is trading at $52.55, a loss of 36 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.5908, a loss of 0.8 cents. Gasoline is trading at $1.5307, a loss of 1.8 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.