EIA Gasoline and Diesel Retail Prices Update

by Dr. Nancy Yamaguchi

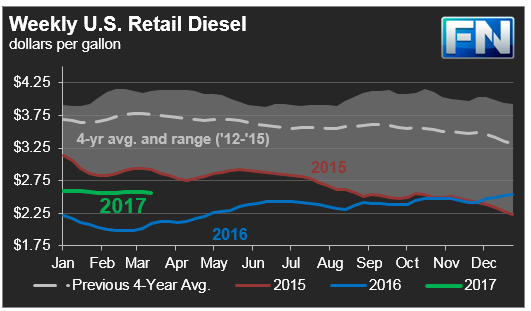

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended March 13th, 2017. Prices for both fuels declined during the week, though the current crude price decline has not yet been fully reflected in retail prices.

For the current week ended March 13th, diesel prices fell by 1.5 cents to an average price of $2.564/gallon.

PADD 1 retail diesel prices declined 1.6cts to $2.617/gallon. In New England, prices fell 1.8 cents to $2.628/gallon. Central Atlantic diesel prices declined by 1.9 cents to average $2.761/gallon. Lower Atlantic prices declined by 1.3 cents to average $2.512/gallon. Overall PADD 1 prices were 46.4cts/gallon above their prices for the same week last year. PBF Energy will be shutting a 46 kbpd diesel hydrotreater at its 160 kbpd Paulsboro, New Jersey, refinery, for a three- to four-week maintenance period. Phillips 66’s 238 kbpd Bayway, New Jersey, refinery, is running at very low throughput. It has met with delays that will push back the restart by another 8-10 days. It was scheduled to restart in mid-March, including its crude unit, its 145 kbpd cat cracker, its cat reformer, and its diesel hydrotreater.

In the Midwest PADD 2 market, retail diesel prices fell 1.1 cents to average $2.491/gallon. This price was 42.6cts/gallon above its level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices declined 1.0 cents to $2.419/gallon. This price was 42.9cts higher than in the previous year. Motiva began to restart the 65 kbpd coker at its 610 kbpd Port Arthur, Texas, refinery. Motiva announced that it would be shutting down its hydrocracker and cutting crude runs at its 230 kbpd Convent, Louisiana, refinery, for a period of around four weeks. This is to finalize repairs on a fire-damaged section that has been closed since August.

In the Rocky Mountains PADD 4 market, retail diesel prices declined 0.8 cents to $2.617/gallon. This price was 61.8cts higher than in the prior year. Prices remain high because of reduced crude runs caused by the closure of Plains All American Pipeline’s Wahsatch Pipeline. Utilization is slightly down at Tesoro’s 63 kbpd refinery and HollyFrontier’s 45 kbpd refinery in the Salt Lake City area, which are having supplemental crude supplies delivered by truck. Suncor’s 103 kbpd refinery at Commerce City, Colorado, was closed because of a full-plant power failure. Safe startup was expected to take several days.

In the West Coast PADD 5 market, diesel pump prices dropped by 3.1 cents to average $2.846/gallon. This price was 56.1 cents above its level last year. Prices excluding California fell 4.3cts to $2.7369/gallon, which was 58.3cts above the retail price for the same week last year. California diesel prices declined by 2.0cts to an average price of $2.936/gallon, 54.6cts higher than last year’s price. Prices were influenced by downtime at one of the hydrocrackers (20 kbpd capacity) at the 77 kbpd Phillips 66 Rodeo refinery near San Francisco.

US retail gasoline prices fell by 1.8cts for the week ended March 13th, to $2.323/gallon. This price was 36.2cts higher than for the same week in 2016.

In the East Coast PADD 1, prices for gasoline declined 1.2cts to $2.273/gallon. This price was 38.9cts higher than last year’s price. Prices edged up 0.01 cents in New England to $2.259/gallon. Central Atlantic market prices declined by 0.2cts to $2.386/gallon. Prices in the Lower Atlantic market dropped by 2.4cts, to bring prices to an average of $2.191/gallon, 33.5cts higher than last year’s average price. PBF Energy reopened the 55 kbpd coker at its Delaware City refinery, which had been out of service since January 12th. PBF is in the process of restarting its 44 kbpd cat reformer and related hydrotreaters.

In the Midwest PADD 2 market, gasoline prices shed 5.0cts to average $2.217/gallon. Gasoline pump prices were 28.8 cents higher than they were one year ago. A fire at PBF Energy’s 188 kbpd Toledo, Ohio, refinery, shut down the plant.

In the Gulf Coast PADD 3 market, gasoline prices fell 1.9 cents to average $2.075/gallon. Prices for the week were 32.9cts higher than for the same week in 2016. Valero’s cat cracker at the 100 kbpd Houston refinery was down for unplanned repairs. Citgo’s Lake Charles, Louisiana, refinery was down because of a power outage on March 7th, and began to be restarted on Friday, March 10th.

In the Rocky Mountains PADD 4 region, gasoline prices rose 1.8 cents to average $2.305/gallon. This price was 43.8cts higher than at the same time in 2016. Supplies have been constrained by the closure of Plains All-American Pipeline’s 100,000 bpd Wahsatch Pipeline. Tesoro and HollyFrontier reduced throughput at their Salt Lake City refineries.

In the West Coast PADD 5 market, retail gasoline prices increased 1.9 cents to an average price of $2.851/gallon. This was 45.7cts higher than at the same time a year ago. Excluding California, prices rose 4.2 cents to an average of $2.584/gallon. This was 53.9cts higher than at the same time in 2016. California prices rose a modest 0.5 cents to an average pump price of $3.005/gallon. California had been first state where retail gasoline prices hit the $3/gallon mark, though the length of the current price downturn may cause California prices to recede as well. Prices were 40.9cts higher than last year’s price for the same week. Los Angeles prices eased by 1.5cts to average $3.037/gallon. San Francisco pump prices declined slightly by 0.2 cents to average $3.029/gallon, 43.8 cents above last year’s price. Seattle prices increased 5.1cts to average $2.828/gallon, 43.8cts higher than prices one year ago. A crude unit at Chevron’s 205 kbpd El Segundo, California, refinery was out of service to repair a leak, and began to come back onstream by the end of the week. PBF Energy restarted its Torrance, California refinery. Tesoro shut the 72 kbpd cat cracker at its 167 kbpd Golden Eagle refinery at Martinez, California, because of a mechanical failure.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.