EIA Gasoline and Diesel Retail Prices Update

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended May 15th, 2017. Prices for both fuels declined, following the downward trend in crude prices, though gasoline prices fell only marginally by a fraction of a cent. Retail prices have followed crude prices down over the past three weeks. If the current price recovery is sustained in the coming week, it will mean the end of retail price easing.

For the current week ended May 15th, diesel prices declined by 2.1 cents to an average price of $2.544/gallon.

PADD 1 retail diesel prices decreased by 1.7 cents to $2.595/gallon. New England prices fell by 1.6 cents to $2.626/gallon. Central Atlantic diesel prices fell by 1.6 cents to average $2.737/gallon. Lower Atlantic prices decreased by 1.9 cents to average $2.488/gallon. PADD 1 prices were 27.4 cents/gallon above their prices for the same week last year. PBF Energy will be shutting a 46 kbpd diesel hydrotreater at its 160 kbpd Paulsboro, New Jersey, refinery, for a three- to four-week maintenance period. Marathon closed a 110 kbpd crude unit at its 240 kbpd Catlettsburg, Kentucky, refinery.

In the Midwest PADD 2 market, retail diesel prices declined by 1.8 cents to average $2.479/gallon. This price was 20.8 cents/gallon above its level for the same week last year. BP will close its 55 kbpd diesel hydrotreater at its 413.5 kbpd Whiting, Indiana, refinery during the first half of May for planned maintenance. BP Husky reduced crude runs at its 160 kbpd Toledo, Ohio, refinery after its 25 kbpd coker broke down.

In the Gulf Coast PADD 3, retail diesel prices dropped by 2.8 cents to $2.382/gallon. This price was 22.5 cents higher than in the previous year. Shell restarted the 60 kbpd hydrocracker at its 340 kbpd Deer Park, Texas, refinery. Motiva continues to work on repairing the H-Oil unit at its 230 kbpd Convent, Louisiana, refinery. Reports indicate that some of the piping infrastructure will need replacement, a process that may take two to three months. This unit suffered two fires, the first in August 2016. There is no schedule yet for a restart. In July, Valero plans to shut down the 55 kbpd ULSD hydrotreater at its 293 kbpd Corpus Christi, Texas, refinery for an overhaul. Total USA is running the 60 kbpd coker at reduced capacity at its 240 kbpd Port Arthur, Texas, refinery following repairs plus an ongoing overhaul of a diesel hydrotreater. Flint Hills is preparing to restart the 15 kbpd hydrocracker at its 300 kbpd Corpus Christi, Texas, refinery, after a failure. HollyFrontier is preparing to return to normal operations at its 140 kbpd El Dorado, Kansas, refinery.

In the Rocky Mountains PADD 4 market, retail diesel prices fell by 2.8 cents to $2.626/gallon. This price was 30.2 cents higher than in the prior year.

In the West Coast PADD 5 market, diesel prices at the pump fell by 2.2 cents to average $2.824/gallon. This price was 29.4 cents above its level last year. Prices excluding California decreased by 1.9 cents to $2.728/gallon, which was 30.3 cents above the retail price for the same week last year. California diesel prices decreased by 2.5 cents to an average price of $2.902/gallon, 28.7 cents higher than last year’s price. Valero was forced to shut down the 34 kbpd hydrocracker at its 145 kbpd refinery at Benicia, California for unplanned repairs, which have extended beyond original estimates. BP shut the 65 kbpd hydrocracker at its 225 kbpd Cherry Point, Washington, refinery for an overhaul. Phillips 66 is preparing to restart the VGO/diesel hydrotreater, a sulfur recovery unit, and a hydrogen plant at its 139 kbpd Carson, California, refinery after completing an extended overhaul.

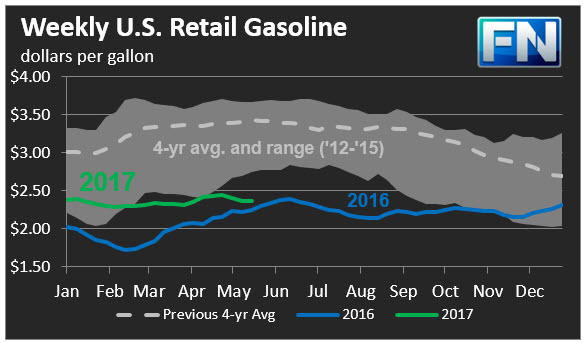

US retail gasoline prices declined modestly by 0.3 cents for the week ended May 15th, to $2.369/gallon. This price was 12.7 cents higher than for the same week in 2016. Gasoline prices had been rising until the past three weeks brought an eight-cent drop. There was significant variation among PADDs, with gasoline prices rising in PADDs 2 and 5, while prices fell in PADDs 1, 3 and 4.

In the East Coast PADD 1, prices for gasoline fell by 2.8 cents to $2.320/gallon. This price was 10.4 cents higher than last year’s price. Prices dropped by 1.7 cents in New England to $2.367/gallon. Central Atlantic market prices decreased by 2.3 cents to $2.437/gallon. Prices in the Lower Atlantic market dropped significantly by 3.5 cents, to bring prices to an average of $2.218/gallon. This was 6.5 cents higher than last year’s average price. PBF Energy began to restart the 82 kbpd cat cracker at its 182.2 kbpd Delaware City refinery. Phillips 66 initiated restart of the 32 kbpd cat reformer at its 238 kbpd Bayway refinery in Linden, New Jersey.

In the Midwest PADD 2 market, retail gasoline prices increased by 3.6 cents to average $2.268/gallon. Gasoline pump prices were 9.0 cents higher than they were one year ago. Phillips 66 closed for unplanned repairs the smaller of its cokers, 20 kbpd, at its 314 kbpd Wood River, Illinois, refinery.

In the Gulf Coast PADD 3 market, gasoline prices fell by 3.9 cents to average $2.129/gallon. Prices for the week were 14.2 cents higher than for the same week in 2016. Motiva continues to have issues repairing the 52 kbpd H-Oil unit at its 230 kbpd Convent, Louisiana, refinery. Placid Refining reduced crude runs and moved up a five-week overhaul of the 25 kbpd cat cracker and related operations at its 75 kbpd Port Allen, Louisiana, refinery. Phillips 66 suffered a breakdown at the lone, 105 kbpd cat cracker at its 247 kbpd Belle Chasse, La., refinery. Valero had a delay restarting the 75 kbpd cat cracker at its Port Arthur, Texas, refinery following repairs, reportedly because of issues with a gas compressor.

In the Rocky Mountains PADD 4 region, gasoline prices decreased 0.9 cents to average $2.384/gallon. This price was 14.1 cents higher than at the same time in 2016.

In the West Coast PADD 5 market, retail gasoline prices rose by 0.9 cents to an average price of $2.872/gallon. This was 22.8 cents higher than at the same time a year ago. Excluding California, prices decreased by 0.8 cents to an average of $2.643/gallon. This was 25 cents higher than at the same time in 2016. In California, prices rose by 1.9 cents to an average pump price of $3.005/gallon. California was the only state market to have gasoline prices above $3/gallon. Prices were 21.6 cents higher than last year’s price for the same week. Los Angeles prices rose by 1.5 cents to average $3.036/gallon. San Francisco pump prices jumped by 3.0 cents to average $3.071/gallon, 19.0 cents above last year’s price. Seattle prices fell 1.0 cents to average $2.863/gallon, 32.4 cents higher than prices one year ago. Tesoro’s 26 kbpd cat reformer at its 120 kbpd Anacortes, Washington, refinery, was shut for unplanned repairs. BP completed an overhaul of the cat reformer and related hydrogen unit at its 227 kbpd Cherry Point, Washington, refinery. Chevron’s 49 kbpd cat reformer at its 273 kbpd El Segundo, California, refinery was out for unplanned repairs. Phillips 66 restored normal operations at its 139 kbpd Carson, California, following restart of its VGO/diesel hydrotreater and related units after an extended overhaul. Valero was forced to close its 145 kbpd Benicia, California, refinery, after a full-plant power failure on Friday. The restart is expected to take a full week. Valero was fined for flaring emissions, which caused local authorities to launch an evacuation of the area. A fire broke near a storage tank at PBF Energy’s 149 kbpd Torrance, California, refinery.

This article is part of Diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.