EIA Gasoline and Diesel Retail Prices Update

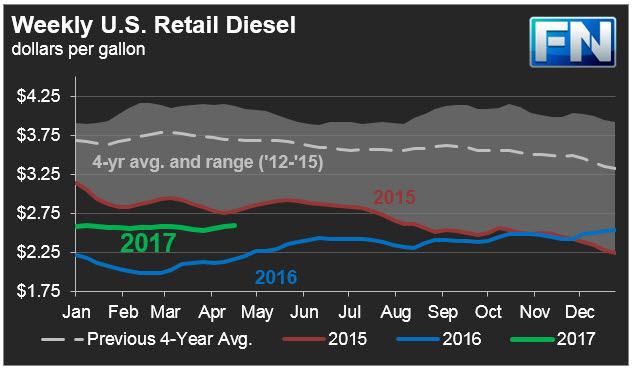

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended April 17th, 2017. Prices for both fuels rose during the week, as they have for the past three weeks.

For the current week ended April 17th, diesel prices rose by 1.5 cents to an average price of $2.597/gallon.

PADD 1 retail diesel prices increased 1.1 cents to $2.631/gallon. New England prices edged down by 0.1 cents to $2.638/gallon, the only submarket where diesel prices did not increase. Central Atlantic diesel prices rose by 2.2 cents to average $2.783/gallon. Lower Atlantic prices increased by 0.6 cents to average $2.522/gallon. Overall, PADD 1 prices were 41.1 cents/gallon above their prices for the same week last year. PBF Energy will be shutting a 46 kbpd diesel hydrotreater at its 160 kbpd Paulsboro, New Jersey, refinery, for a three- to four-week maintenance period. Phillips 66’s 238 kbpd Bayway, New Jersey, refinery, remains running at very low throughput. It was scheduled to restart in mid-March, including its crude unit, its 145 kbpd cat cracker, its cat reformer, and its diesel hydrotreater. But delays pushed back the restart until the 31st, and since then, poor economics have kept throughput low.

In the Midwest PADD 2 market, retail diesel prices increased 2.1 cents to average $2.536/gallon. This price was 42.4 cents/gallon above its level for the same week last year. Tesoro closed its 75 kbpd Mandan, North Dakota, refinery for a full-plant overhaul, earlier than the originally scheduled April 4th date. The overhaul includes a diesel hydrotreater. BP restored normal operations at a 110 kbpd crude unit (one of three crude towers) at its 413.5 kbpd Whiting, Indiana, refinery. BP will close its 55 kbpd diesel hydrotreater during the first half of May for planned maintenance.

In the Gulf Coast PADD 3, retail diesel prices rose 1.2 cents to $2.458/gallon. This price was 41.2 cents higher than in the previous year. ExxonMobil shut down the 65 kbpd hydrocracker at its 345 kbpd Beaumont, Texas refinery to remedy a mechanical failure. This refinery has a crude unit and a 48 kbpd coker in maintenance currently. ExxonMobil restarted the 29.5 kbpd hydrocracker at its Baytown, Texas, refinery, which was closed to repair a leak. Marathon resumed planned rates at the 238 kbpd crude unit at its 522 kbpd Garyville, Louisiana, which was down for unplanned repairs. Valero is restoring normal rates at the 50 kbpd hydrocracker at its 350 kbpd Port Arthur, Texas, refinery. The unit was closed March 30th because of a mechanical failure. Motiva continues to have issues repairing the H-Oil unit at its 230 kbpd Convent, Louisiana, refinery. Reports indicate that some of the piping infrastructure will need replacement, a process that may take two to three months.

In the Rocky Mountains PADD 4 market, retail diesel prices increased 1.2 cents to $2.652/gallon. This price was 48.1 cents higher than in the prior year.

In the West Coast PADD 5 market, diesel prices at the pump increased by 1.9 cents to average $2.877/gallon. This price was 50.6 cents above its level last year. Prices excluding California rose 1.9 cents to $2.791/gallon, which was 54 cents above the retail price for the same week last year. California diesel prices increased by 1.1 cents to an average price of $2.946/gallon, 48 cents higher than last year’s price. Shell is preparing for maintenance at the 42 kbpd hydrocracker at its 165 kbpd Martinez, California, refinery, to commence at the end of April or early May. Valero was forced to shut down the 34 kbpd hydrocracker at its 145 kbpd refinery at Benicia, California for unplanned repairs. BP shut the 65 kbpd hydrocracker at its 225 kbpd Cherry Point, Washington, refinery for an overhaul. PBF Energy reduced throughput at the 88 kbpd VGO hydrotreater at its 149 kbpd Torrance, California, refinery, for more unplanned repairs. This unit is scheduled for a seven-week overhaul in late April/Early May. The hydrocracker is scheduled for a five-week overhaul.

US retail gasoline prices increased by 1.2 cents for the week ended April 17th, to $2.436/gallon. This price was 29.9 cents higher than for the same week in 2016. Gasoline prices are at their highest levels since the week ended August 31st, 2015.

In the East Coast PADD 1, prices for gasoline rose by 2.3 cents to $2.397/gallon. This price was 30 cents higher than last year’s price. Prices jumped by 4.7 cents in New England to $2.373/gallon. Central Atlantic market prices rose by 4.1 cents to $2.508/gallon. Prices in the Lower Atlantic market edged up by 0.2 cents, to bring prices to an average of $2.32/gallon, 29.7 cents higher than last year’s average price. Philadelphia Energy Solutions restarted the 6 kbpd alkylation unit at its Point Breeze, Philadelphia, refinery, which had been closed March 29th for unplanned repairs.

The only PADD where gasoline prices did not rise was the Midwest PADD 2 market, where retail gasoline prices declined by 2.2 cents to average $2.339/gallon. Gasoline pump prices were 28.2 cents higher than they were one year ago.

Tesoro was forced to on Friday to close its 75 kbpd Mandan, North Dakota, refinery for a full-plant overhaul after a power outage and steam plant failure. The refinery includes a cat cracker and a cat reformer. The overhaul was originally scheduled for April 4th. Phillips 66 is in the process of restarting its314 kbpd Wood River, Illinois, refinery.

In the Gulf Coast PADD 3 market, gasoline prices were hiked by 4.9 cents to average $2.241/gallon. Prices for the week were 33.1 cents higher than for the same week in 2016. Valero had a power outage at the 95 kbpd Three Rivers, Texas, refinery, which took down its cat reformer. Valero was forced to close the 86 kbpd cat cracker and 15 kbpd alkylation unit at its 225 kbpd Texas City refinery. LyondellBasell’s Houston refinery continues to work on repairs to the cooling unit at its 110 kbpd cat cracker, which was seriously damaged by a fire on March 15th. Phillips 66 restored operations at the 35 kbpd cat cracker at its 146 kbpd Borger, Texas refinery following overhaul. Motiva continues to have issues repairing the H-Oil unit at its 230 kbpd Convent, Louisiana, refinery, and repairs are expected to take up to three months. Citgo is experiencing delays overhauling the 46 kbpd cat cracker at its 425 kbpd Lake Charles, Louisiana, refinery. Phillips 66 has been delayed completing maintenance the 60 kbpd coker at its 275 kbpd Westlake, Louisiana, refinery.

In the Rocky Mountains PADD 4 region, gasoline prices jumped 4.3 cents to average $2.376/gallon. This price was 29.8 cents higher than at the same time in 2016.

In the West Coast PADD 5 market, retail gasoline prices rose by a penny to an average price of $2.883/gallon. This was 29.2 cents higher than at the same time a year ago. Excluding California, prices rose by 1.3 cents to an average of $2.652/gallon. This was 37.3 cents higher than at the same time in 2016. In California, prices increased 0.9 cents to an average pump price of $3.017/gallon. California remained the only state market to have gasoline prices top $3 once again. Prices were 24.6 cents higher than last year’s price for the same week. Los Angeles prices rose by 2.3 cents to average $3.055/gallon. San Francisco pump prices increased by 1.1 cents to average $3.061/gallon, 23.9 cents above last year’s price. Seattle prices rose 0.4 cents to average $2.882/gallon, 57.3.0cts higher than prices one year ago. Tesoro shut the 26 kbpd cat reformer and the 39 kbpd naphtha hydrotreater at its 120 kbpd Anacortes, Washington, refinery, for unplanned repairs, and the downtime has been extended.

This article is part of Diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.