EIA Gasoline and Diesel Retail Prices Update

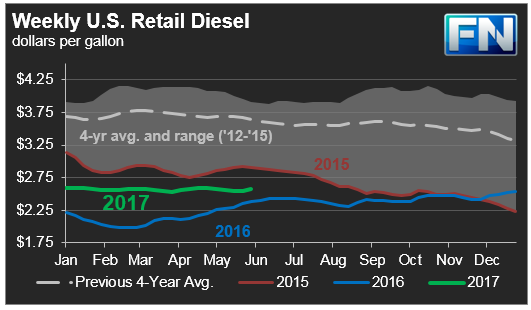

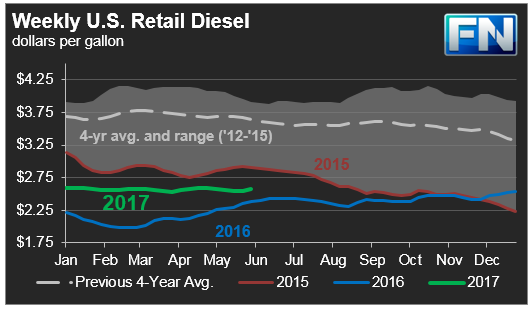

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended May 29th, 2017. The data release was delayed by one day in observance of Memorial Day. Prices for diesel rose significantly, while gasoline prices rose modestly. Retail prices followed crude prices up during the week leading to the OPEC meeting. Since then, prices have relaxed somewhat. If prices continue to weaken, it is likely that this will be reflected in next week’s retail prices.

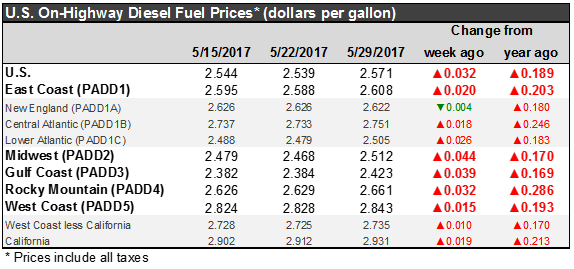

For the current week ended May 29th, diesel prices rose by 3.2 cents to an average price of $2.571/gallon.

PADD 1 retail diesel prices increased by 2.0 cents to $2.608/gallon. New England prices declined by 0.4 cents to average $2.622/gallon. Central Atlantic diesel prices rose by 1.8 cents to average $2.751/gallon. Lower Atlantic prices increased by 2.6 cents to average $2.505/gallon. PADD 1 prices were 20.3 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices rose by 4.4 cents to average $2.512/gallon. This price was 17 cents/gallon above its level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices rose by 3.9 cents to $2.423/gallon. This price was 16.9 cents higher than in the previous year. Shell is reportedly close to achieving normal operations at the heavy oil hydrocracker at its 237 kbpd Convent, Louisiana, refinery. In July, Valero plans to shut down the 55 kbpd ULSD hydrotreater at its 293 kbpd Corpus Christi, Texas, refinery for an overhaul. Valero was forced to shut its 94 kbpd heavy oil cracker for instrumentation problems which resulted in visible flaring. Also in Corpus Christi, Citgo closed its 165 kbpd crude unit and reduced other operations because of power issues.

In the Rocky Mountains PADD 4 market, retail diesel prices rose by 3.2 cents to $2.661/gallon. This price was 28.6 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices rose by 1.5 cents to average $2.843/gallon. This price was 19.3 cents above its level last year. Prices excluding California increased by 1.0 cents to $2.735/gallon, which was 17 cents above the retail price for the same week last year. California diesel prices increased by 1.9 cents to an average price of $2.931/gallon, 21.3 cents higher than last year’s price. Valero was forced to shut down the 34 kbpd hydrocracker at its 145 kbpd refinery at Benicia, California for unplanned repairs, which have extended beyond original estimates. BP shut the 65 kbpd hydrocracker at its 225 kbpd Cherry Point, Washington, refinery for an overhaul. Phillips 66 is preparing to restart the VGO/diesel hydrotreater, a sulfur recovery unit, and a hydrogen plant at its 139 kbpd Carson, California, refinery after completing an extended overhaul.

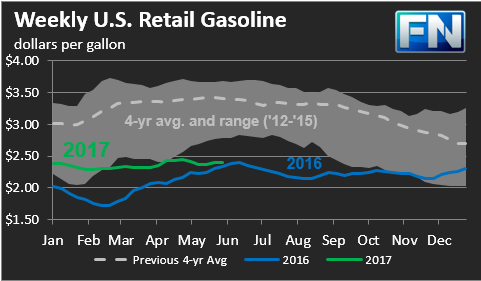

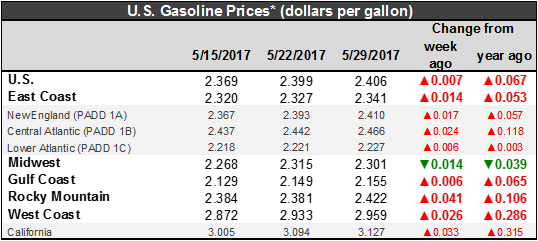

US retail gasoline prices increased by 0.7 cents for the week ended May 29th, to $2.406/gallon. This price was 6.7 cents higher than for the same week in 2016. Gasoline prices had been trending down until last week. This current week brought higher prices to all PADDs save PADD 2.

In the East Coast PADD 1, prices for gasoline rose by 1.4 cents to $2.341/gallon. This price was 5.3 cents higher than last year’s price. Prices rose by 1.7 cents in New England to $2.410/gallon. Central Atlantic market prices increased by 2.4 cents to $2.466/gallon. Prices in the Lower Atlantic market rose by 0.6 cents, to bring prices to an average of $2.227/gallon. This was very close (0.3 cents higher) to last year’s average price. Valero had a power outage at its 190 kbpd Memphis, Tennessee, refinery, which temporarily shut down the 70 kbpd cat cracker, 12 kbpd alkylation unit, and hydrogen unit.

The Midwest PADD 2 market was the only PADD where retail gasoline prices declined last week, falling 1.4 cents to average $2.301/gallon. PADD 2 had the distinction of being the only PADD where prices have fallen below their levels of last year. Gasoline pump prices were 3.9 cents lower than they were one year ago.

In the Gulf Coast PADD 3 market, gasoline prices rose by 0.6 cents to average $2.155/gallon. Prices for the week were 6.5 cents higher than for the same week in 2016. Marathon Petroleum resumed normal operations at the 58.5 kbpd cat cracker at its 84 kbpd Texas City, Texas, refinery after restarting its 15 kbpd alkylation unit. Motiva continues to have issues repairing the 52 kbpd H-Oil unit at its 230 kbpd Convent, Louisiana, refinery. Placid Refining reduced crude runs and moved up a five-week overhaul of the 25 kbpd cat cracker and related operations at its 75 kbpd Port Allen, Louisiana, refinery. Valero was forced to shut the 94 kbpd heavy oil cracker at its 293 kbpd Corpus Christi, Texas, refinery for instrumentation problems which resulted in visible flaring.

In the Rocky Mountains PADD 4 market, gasoline pump prices rose by 4.1 cents to average $2.422/gallon. This price was 10.6 cents higher than at the same time in 2016.

In the West Coast PADD 5 market, retail gasoline prices rose by 2.6 cents to an average price of $2.959/gallon. This was 28.6 cents higher than at the same time a year ago. Excluding California, prices increased by 1.2 cents to an average of $2.668/gallon. This was 23.5 cents higher than at the same time in 2016. In California, prices rose by 3.3 cents to an average pump price of $3.127/gallon. California remained the only state market to have gasoline prices above $3/gallon. Prices were 31.5 cents higher than last year’s price for the same week. Los Angeles prices rose by 0.9 cents to average $3.101/gallon. San Francisco pump prices increased by 4.6 cents to average $3.232/gallon, 34.9 cents above last year’s price. Seattle prices decreased 0.1 cents to average $2.872/gallon, 26.8 cents higher than prices one year ago. Shell resumed normal operations at the polymerization unit at its 145 kbpd Anacortes, Washington, refinery. Tesoro initiated restart on the 30 kbpd cat reformer at its 265 kbpd Carson, California, refinery following extended overhaul, but met with another delay during the week.

This article is part of Daily Market News & Insights

Tagged: diesel prices, eia, gasoline prices, Retail Prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.