EIA Data Contradicts API Report

Happy Thanksgiving! Whether you’re a Mansfield customer, a supply or carrier partner, or simply a fan of fuel markets – thank you for choosing FUELSNews as your source for market analysis.

We will resume our daily publication on Monday, November 26.

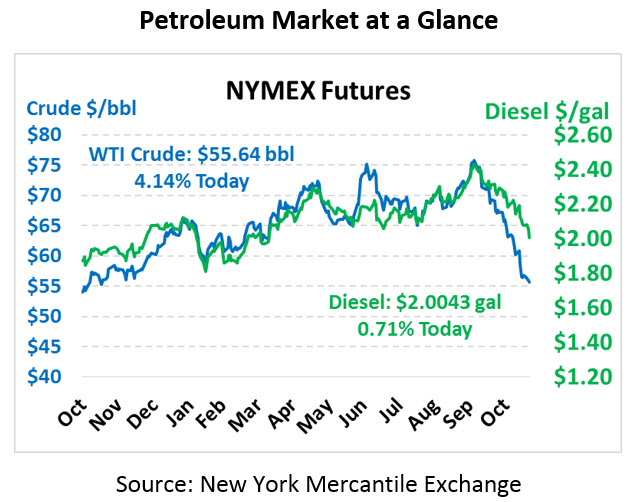

Once again the markets took a huge hit yesterday, with crude and gasoline reaching new annual lows while diesel fell to a 7-month low. Although holiday week trading tends to be light, yesterday saw volumes swell to become the 5th heaviest trading day of 2018. WTI crude sank $3.40 yesterday as the stock market plummeted, both tracking fears of weakening growth in developing economies. Crude this morning is rallying to recoup some of the losses, trading at $55.64 for a $2.21 gain (+4.1%).

Fuel prices took a sizable hit yesterday, with gasoline prices shedding 9 cents while diesel prices were down 7 cents. This morning, diesel prices are trading at $2.0043, up 1.4 cents after closing below $2/gal for the first time since April this year. Gasoline prices have picked up 4.3 cents to trade at $1.5386, after closing below $1.50 for the first time since July 2017.

Leading up to the December 6 OPEC meeting, markets are closely watching OPEC members for clues of the outcome. The UAE, Saudi Arabia, and Iraq all appear to be on-board with production cuts, representing the bulk of the decision-making power in OPEC. However, Russia still has not shown any interest in complying, leaving some to wonder whether OPEC+ will become just OPEC in 2019.

EIA Data

The EIA’s data this morning completely contradicted the API’s forecast. While the API reported a surprise crude stock draw, the EIA showed a build nearly double the market’s expectations. Diesel’s draw this week was underwhelming, and gasoline showed a steeper draw than expected (contrasted against the API’s predicted build).

In other EIA news, refinery utilization climbed to 92.7%, bringing utilization back into the 90s and signaling the end of refinery maintenance season. Refiners are focusing on pumping out more distillates now, cutting back gasoline output given the 50-cent premium on diesel currently and causing a marginal boost in distillate production.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.